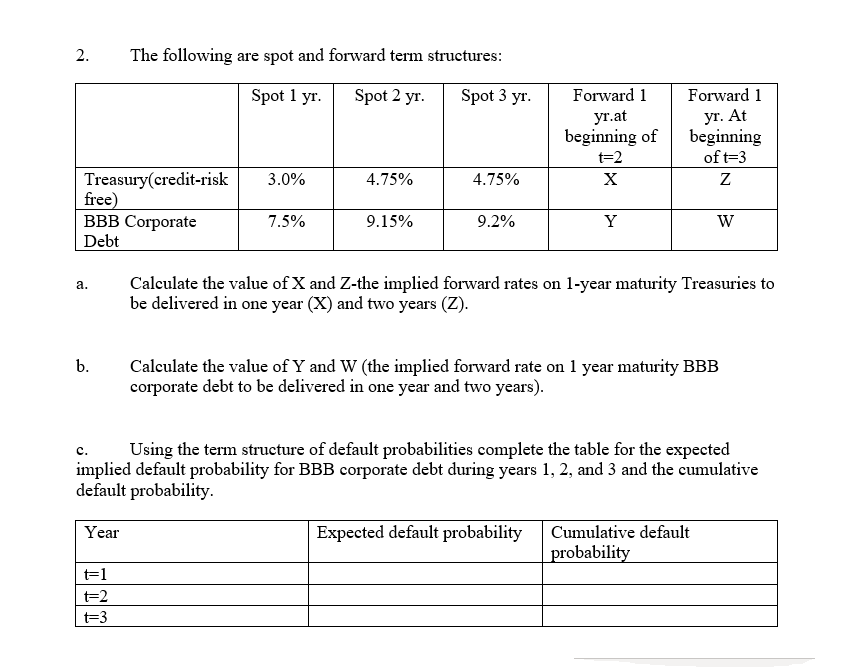

Question: 2. The following are spot and forward term structures: Spot 1 yr. Spot 2 yr. Spot 3 yr. Forward 1 yr.at beginning of Forward 1

2. The following are spot and forward term structures: Spot 1 yr. Spot 2 yr. Spot 3 yr. Forward 1 yr.at beginning of Forward 1 yr. At beginning oft=3 Z t=2 3.0% 4.75% 4.75% Treasury(credit-risk free) BBB Corporate Debt 7.5% 9.15% 9.2% Y W a. Calculate the value of X and Z-the implied forward rates on 1-year maturity Treasuries to be delivered in one year (X) and two years (Z). b. Calculate the value of Y and W (the implied forward rate on 1 year maturity BBB corporate debt to be delivered in one year and two years). c. Using the term structure of default probabilities complete the table for the expected implied default probability for BBB corporate debt during years 1, 2, and 3 and the cumulative default probability. Year Expected default probability Cumulative default probability t=1 t=2 t=3 2. The following are spot and forward term structures: Spot 1 yr. Spot 2 yr. Spot 3 yr. Forward 1 yr.at beginning of Forward 1 yr. At beginning oft=3 Z t=2 3.0% 4.75% 4.75% Treasury(credit-risk free) BBB Corporate Debt 7.5% 9.15% 9.2% Y W a. Calculate the value of X and Z-the implied forward rates on 1-year maturity Treasuries to be delivered in one year (X) and two years (Z). b. Calculate the value of Y and W (the implied forward rate on 1 year maturity BBB corporate debt to be delivered in one year and two years). c. Using the term structure of default probabilities complete the table for the expected implied default probability for BBB corporate debt during years 1, 2, and 3 and the cumulative default probability. Year Expected default probability Cumulative default probability t=1 t=2 t=3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts