Question: 2. The Following data is known for Kaiser & Co a) Determine the following: I. Accounts receivable (average) II. Current Liabilities (average) III. Current Assets

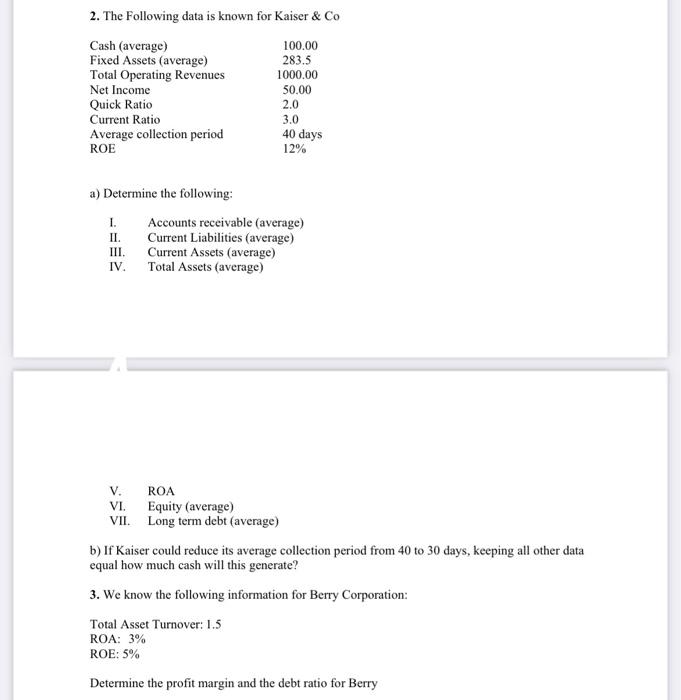

2. The Following data is known for Kaiser \& Co a) Determine the following: I. Accounts receivable (average) II. Current Liabilities (average) III. Current Assets (average) IV. Total Assets (average) V. ROA VI. Equity (average) VII. Long term debt (average) b) If Kaiser could reduce its average collection period from 40 to equal how much cash will this generate? 3. We know the following information for Berry Corporation: Total Asset Turnover: 1.5 ROA:3% ROE: 5% Determine the profit margin and the debt ratio for Berry

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock