Question: 2) The following table summarizes the information regarding two stocks, Mays Corporation and Aggies United. The market's expected premium is 6% and the T-Bill rate

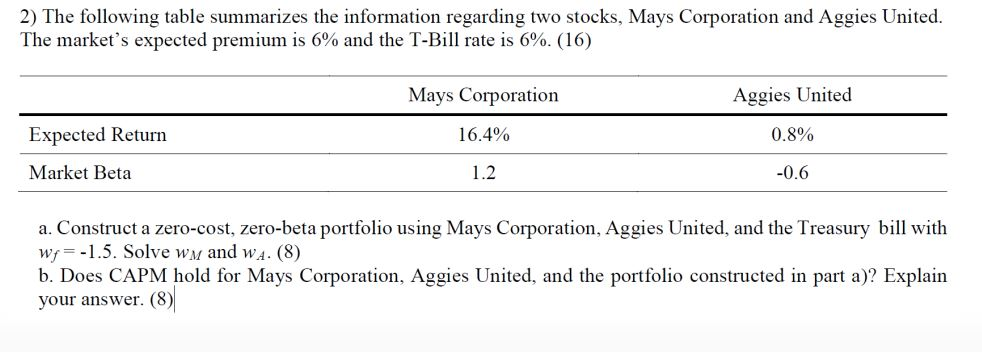

2) The following table summarizes the information regarding two stocks, Mays Corporation and Aggies United. The market's expected premium is 6% and the T-Bill rate is 6%. (16) Mays Corporation Aggies United Expected Return 16.4% 0.8% Market Beta 1.2 -0.6 a. Construct a zero-cost, zero-beta portfolio using Mays Corporation, Aggies United, and the Treasury bill with wr=-1.5. Solve wm and w4. (8) b. Does CAPM hold for Mays Corporation, Aggies United, and the portfolio constructed in part a)? Explain your answer. (8) 2) The following table summarizes the information regarding two stocks, Mays Corporation and Aggies United. The market's expected premium is 6% and the T-Bill rate is 6%. (16) Mays Corporation Aggies United Expected Return 16.4% 0.8% Market Beta 1.2 -0.6 a. Construct a zero-cost, zero-beta portfolio using Mays Corporation, Aggies United, and the Treasury bill with wr=-1.5. Solve wm and w4. (8) b. Does CAPM hold for Mays Corporation, Aggies United, and the portfolio constructed in part a)? Explain your answer. (8)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts