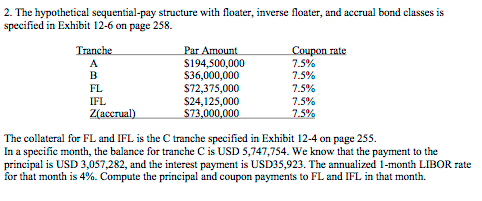

Question: 2. The hypothetical sequential-pay structure with floater, inverse floater, and accrual bond classes is specified in Exhibit 12-6 on page 258. S194.500,000 S36,000,000 S72,375,000 S24,125,000

2. The hypothetical sequential-pay structure with floater, inverse floater, and accrual bond classes is specified in Exhibit 12-6 on page 258. S194.500,000 S36,000,000 S72,375,000 S24,125,000 7.5% 7.5% 75% 7.5% FL IFL The collateral for FL and IFL is the C tranche specified in Exhibit 12-4 on page 255 In a specific month, the balance for tranche C is USD 5,747,754. We know that the payment to the principal is USD 3,057,282, and the interest payment is USD35,923. The annualized 1-month LIBOR rate for that month is 4%. Compute the principal and coupon payments to FL and IFL in that month. 2. The hypothetical sequential-pay structure with floater, inverse floater, and accrual bond classes is specified in Exhibit 12-6 on page 258. S194.500,000 S36,000,000 S72,375,000 S24,125,000 7.5% 7.5% 75% 7.5% FL IFL The collateral for FL and IFL is the C tranche specified in Exhibit 12-4 on page 255 In a specific month, the balance for tranche C is USD 5,747,754. We know that the payment to the principal is USD 3,057,282, and the interest payment is USD35,923. The annualized 1-month LIBOR rate for that month is 4%. Compute the principal and coupon payments to FL and IFL in that month

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts