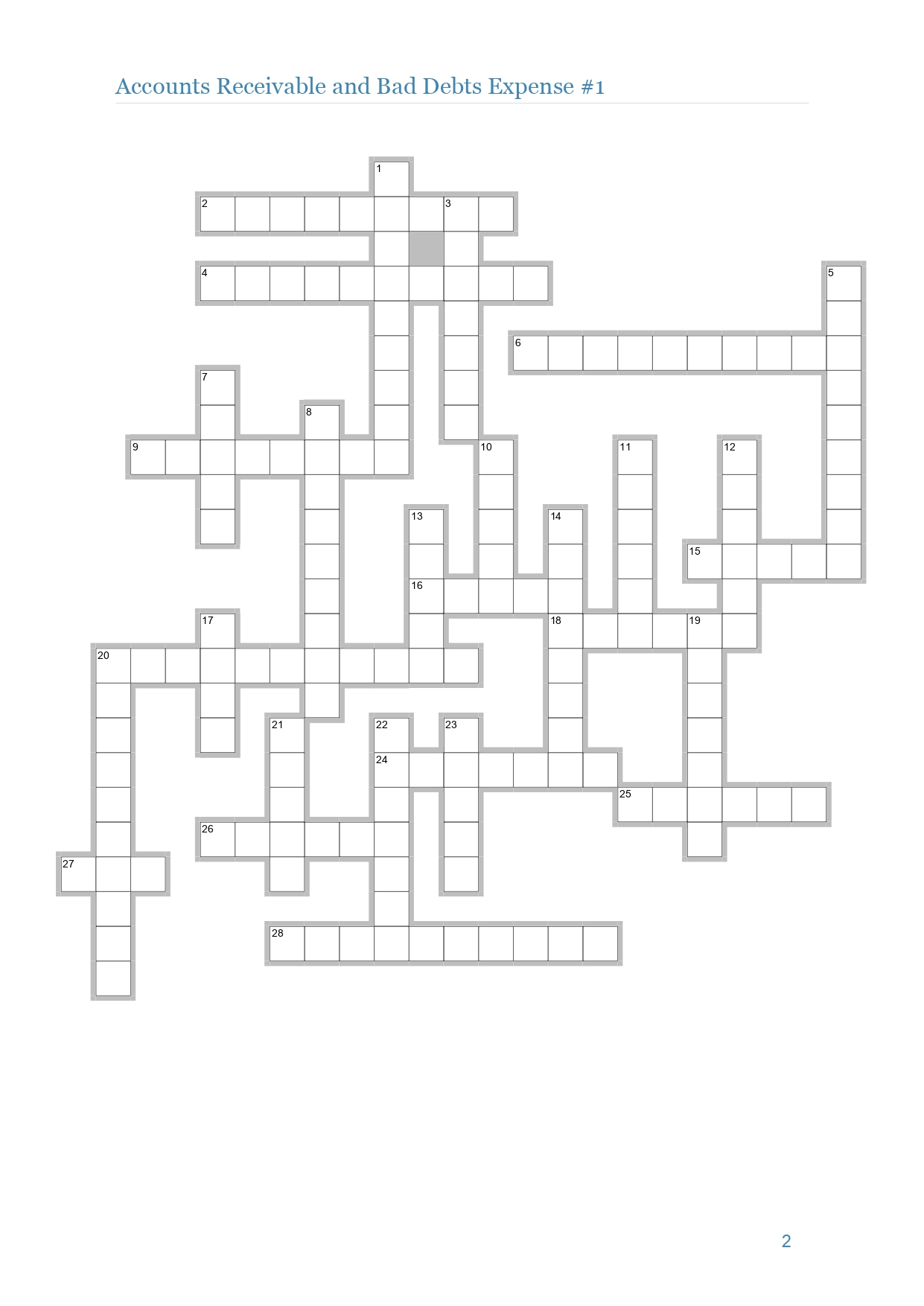

Question: 2 The method for recording bad debts expense i s the preferred method t o b e used o n a company's financial statements. A

The method for recording bad debts expense the preferred method

used a company's financial statements.

A company might borrow money using its accounts receivable

for the

loan.

remind customers the amount owes, a company will mail

these

customers. This document will show the open unpaid invoices.

When goods are shipped FOB

point, the sale and accounts receivable will

occur the seller's dock.

net example credit

Under the allowance method, the writeoff a bad account will involve two current

accounts.

Usually the Allowance for Doubtful Accounts will have a balance.

The aging accounts receivable associated with the percentage

method

for determining the amount Bad Debts Expense.

The calculation the accounts receivable turnover ratio net credit sales divided the

balance accounts receivable.

A company that the business purchasing accounts receivable.

The allowance account associated with accounts receivable

asset account.

The direct writeoff method required for federal income

purposes.

When uncollectible account written off, the account credited Accounts The sale accounts receivable.

Accounts receivable classified the balance sheet

asset.

Sales allow customers deduct a small percentage the amount owed the

customer pays the amount owed within a specified period time.

A trade discount often expressed a percentage that a customer can deduct from a list

appearing a catalog.

While the control account for Accounts Receivable can updated only when

statements are prepared, the subsidiary ledger for accounts receivable should updated

often possible.

Under the allowance method, the percentage

approach focuses the income

statement rather than the balance sheet.

Under the allowance method, the journal entry writeoff a bad account will not cause a change

the amount a company's net

There allowance account when using the

writeoff method recognizing bad

debts expense.

Accounts Receivable that arise from the regular sales merchandise are also referred

receivables.

A company with millions credit transactions will find that the allowance method does a better

job

bad debts expense with revenues than the direct writeoff method.

Bad Expense also referred Uncollectible Account Expense.

The document sent the customer when merchandise shipped a sales

Accounts receivable minus the allowance for uncollectible accounts the calculation

determine the net

cash value the accounts receivable.

Sorting the accounts receivable into current, days past due, days past due, and

known the accounts receivable.

When using the percentage receivables under the allowance method, the focus

obtaining the appropriat

the allowance account.

a company using the allowance method writes off more than the balance available its

allowance account, the account will have

balance.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock