Question: 2 . The owner of a medium - size electronics company is concemed about cash flow. The company operates in a growing industry and produces

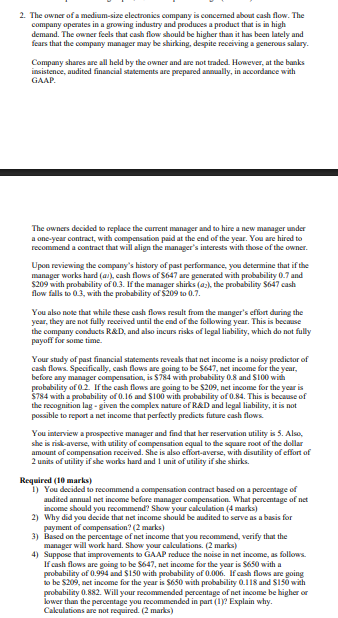

The owner of a mediumsize electronics company is concemed about cash flow. The company operates in a growing industry and produces a product that is in high demand. The owner feels that cash flow should be higher than it has been lately and fears that the compamy manager may be shirking, despite receiving a generous salary. Company shares are all held by the owner and are not traded. However, at the banks insistence, audited financial statements are prepared annaally, in accordance with GAAP. The owners decided to replace the current manager and to hire a new manager under a oneyear contract, with compensation paid at the end of the year. You are hired to recommend a contract that will align the manager's interests with those of the owner. Upon reviewing the company's history of past performance, you determine that if the manager works hard a cash flows of $ are generated with probability and $ with probability of If the manager shirks a the probability $ cash flow falls to with the probability of $ to You also note that ahile these cash flows result from the manger's effort daring the year, they are not fully received until the end of the following year. This is becanse the company condacts R&D and also incurs risks of legal liability, which do not fully payoff for some time. Your study of past financial statements reveak that net income is a noisy predictor of cash flows. Specifically, cash flows are going to be $ net income for the year, before any manager compensation, is $ with probability and $ with probability of If the cash flows are going to be $ net incone for the year is $ with a probability of and $ with probability of This is because of the recognition lag given the complex nature of R&D and legal liability, it is not possible to report a net income that perfectly predicts future cash flows. You interview a prospective manager and find that her reservation utility is Alsa, she is riskaverse, with utility of compensation equal to the square root of the dollar amount of compensation received. She is also effortaverse, with disutility of effort of units of utility if she works hard and unit of utility if she shirks. Required marks You decided to recommend a compensation contract based on a percentage of audited annual net income before manager compensation. What percentage of net income should you recommend? Show your calculation marks Why did you decide that net income should be aodited to serve as a basis for payment of compensation? marks Based on the percentage of net income that you recommend, verify that the manager will work hard. Show your calculations. marls Suppose that improvements to GAAP reduce the noise in net income, as follows. If cash flows are going to be $ net income for the year is $ with a probability of and $ with probability of If cash flows are going to be $ net income for the year is $ with probability and $ with probability Will your recommended percentage of net income be higher or lower than the percentage you recommended in part Explain why. Cakulations are not required. marks

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock