Question: 2. The QBI deduction is: a. An itemized deduction. b. A deduction from AGI. c. A deduction for AGI. d. A deduction claimed on Schedule

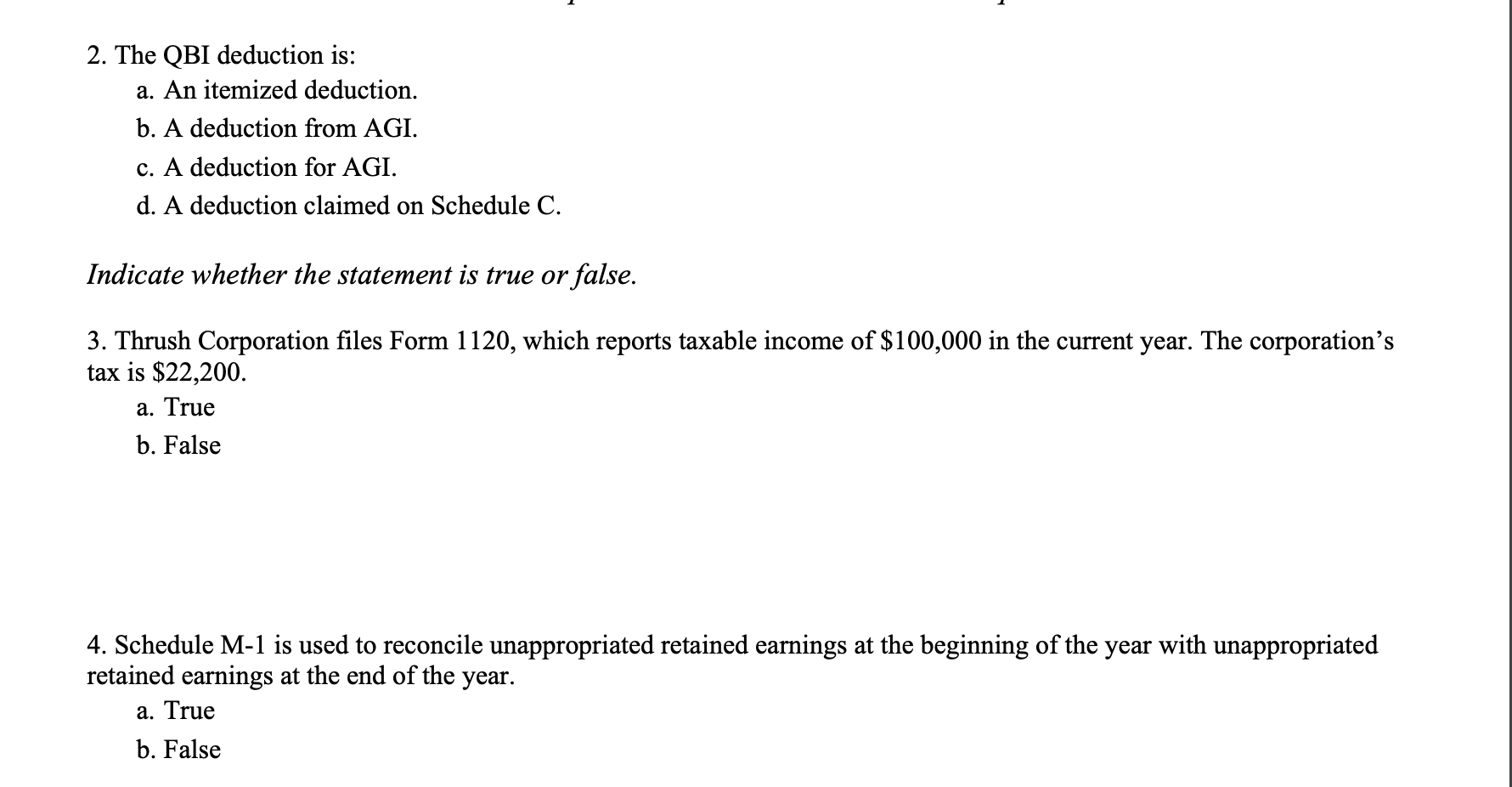

2. The QBI deduction is: a. An itemized deduction. b. A deduction from AGI. c. A deduction for AGI. d. A deduction claimed on Schedule C. Indicate whether the statement is true or false. 3. Thrush Corporation files Form 1120, which reports taxable income of $100,000 in the current year. The corporation's tax is $22,200. a. True b. False 4. Schedule M-1 is used to reconcile unappropriated retained earnings at the beginning of the year with unappropriated retained earnings at the end of the year. a. True b. False

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts