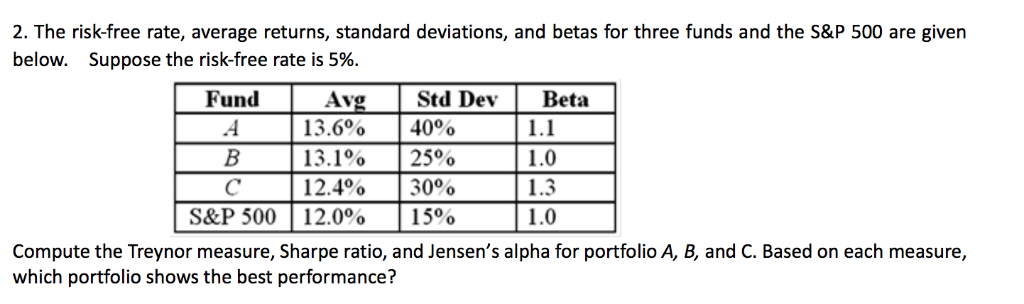

Question: 2. The risk-free rate, average returns, standard deviations, and betas for three funds and the S&P 500 are given below. Suppose the risk-free rate is

2. The risk-free rate, average returns, standard deviations, and betas for three funds and the S&P 500 are given below. Suppose the risk-free rate is 5%. Fund AvStd DevBeta | 13.6% | 13.1% 12.4% | 12.0% | 40% | 25% |30% | 15% | 1.0 1.3 1.0 S&P 500 Compute the Treynor measure, Sharpe ratio, and Jensen's alpha for portfolio A, B, and C. Based on each measure, which portfolio shows the best performance

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock