Question: 2. The table below table shows settlement prices for live cattle futures. One contract represents 400 cwt. Prices are quoted in dollars and cents per

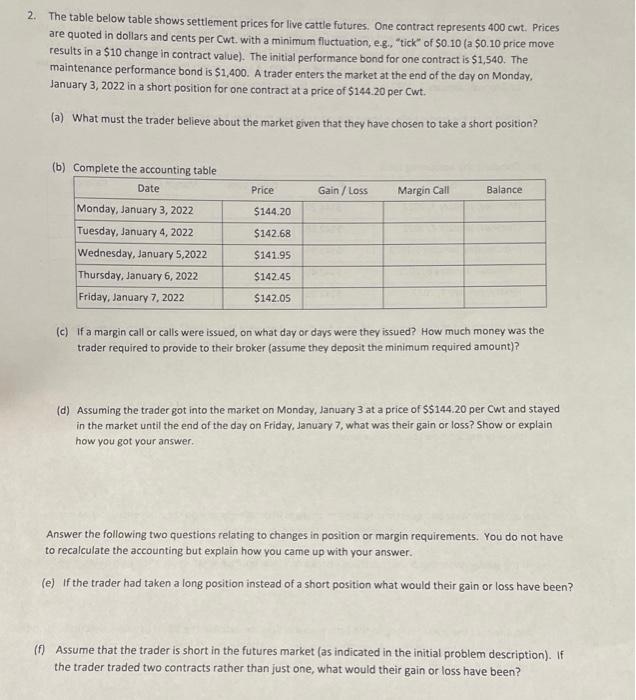

2. The table below table shows settlement prices for live cattle futures. One contract represents 400 cwt. Prices are quoted in dollars and cents per Cwt. with a minimum fluctuation, e.g., "tick of $0.10 (a $0.10 price move results in a $10 change in contract value). The initial performance bond for one contract is $1,540. The maintenance performance bond is $1,400. A trader enters the market at the end of the day on Monday, January 3, 2022 in a short position for one contract at a price of $144.20 per Cwt. (a) What must the trader believe about the market given that they have chosen to take a short position? Price Gain / Loss Margin Call Balance $144.20 (b) Complete the accounting table Date Monday, January 3, 2022 Tuesday, January 4, 2022 Wednesday, January 5,2022 Thursday, January 6, 2022 Friday, January 7, 2022 $142.68 $141.95 $142.45 $142.05 (c) if a margin call or calls were issued, on what day or days were they issued? How much money was the trader required to provide to their broker (assume they deposit the minimum required amount)? (d) Assuming the trader got into the market on Monday, January 3 at a price of S$144.20 per Cwt and stayed in the market until the end of the day on Friday, January 7, what was their gain or loss? Show or explain how you got your answer. Answer the following two questions relating to changes in position or margin requirements. You do not have to recalculate the accounting but explain how you came up with your answer. (e) if the trader had taken a long position instead of a short position what would their gain or loss have been? (f) Assume that the trader is short in the futures market (as indicated in the initial problem description). If the trader traded two contracts rather than just one, what would their gain or loss have been

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts