Question: 2. The target capital structure Aa Aa Think about managing a firm's capital structure and trying to achieve and maintain its target and/or optimal capital

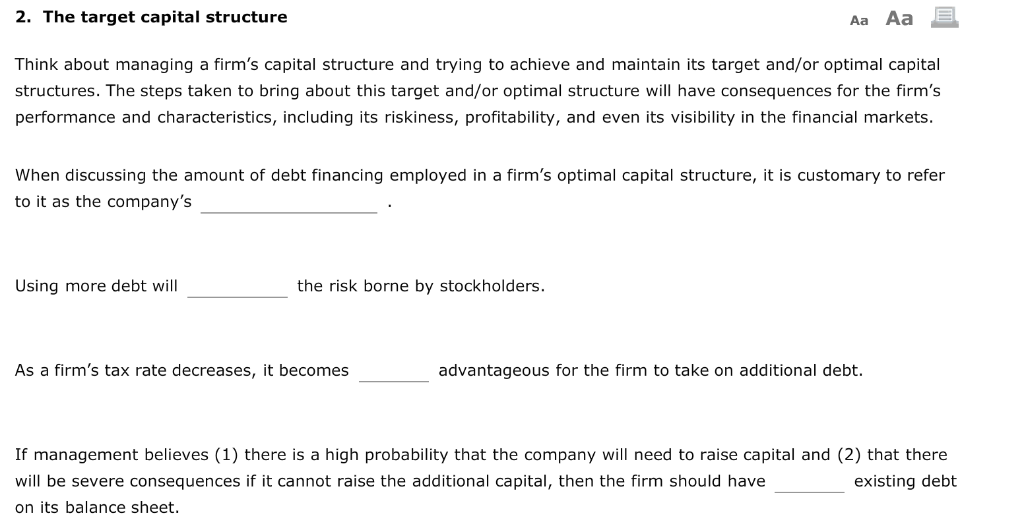

2. The target capital structure Aa Aa Think about managing a firm's capital structure and trying to achieve and maintain its target and/or optimal capital structures. The steps taken to bring about this target and/or optimal structure will have consequences for the firm's performance and characteristics, including its riskiness, profitability, and even its visibility in the financial markets. When discussing the amount of debt financing employed in a firm's optimal capital structure, it is customary to refer to it as the company's Using more debt will the risk borne by stockholders. As a firm's tax rate decreases, it becomes advantageous for the firm to take on additional debt. If management believes (1) there is a high probability that the company will need to raise capital and (2) that there will be severe consequences if it cannot raise the additional capital, then the firm should have existing debt on its balance sheet

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts