Question: 2) There are differences between the IFRS and GAAP (after FASB issued ASU 2017-04 to simplify the accounting for goodwill impairment) regarding the following: Assignment/allocation

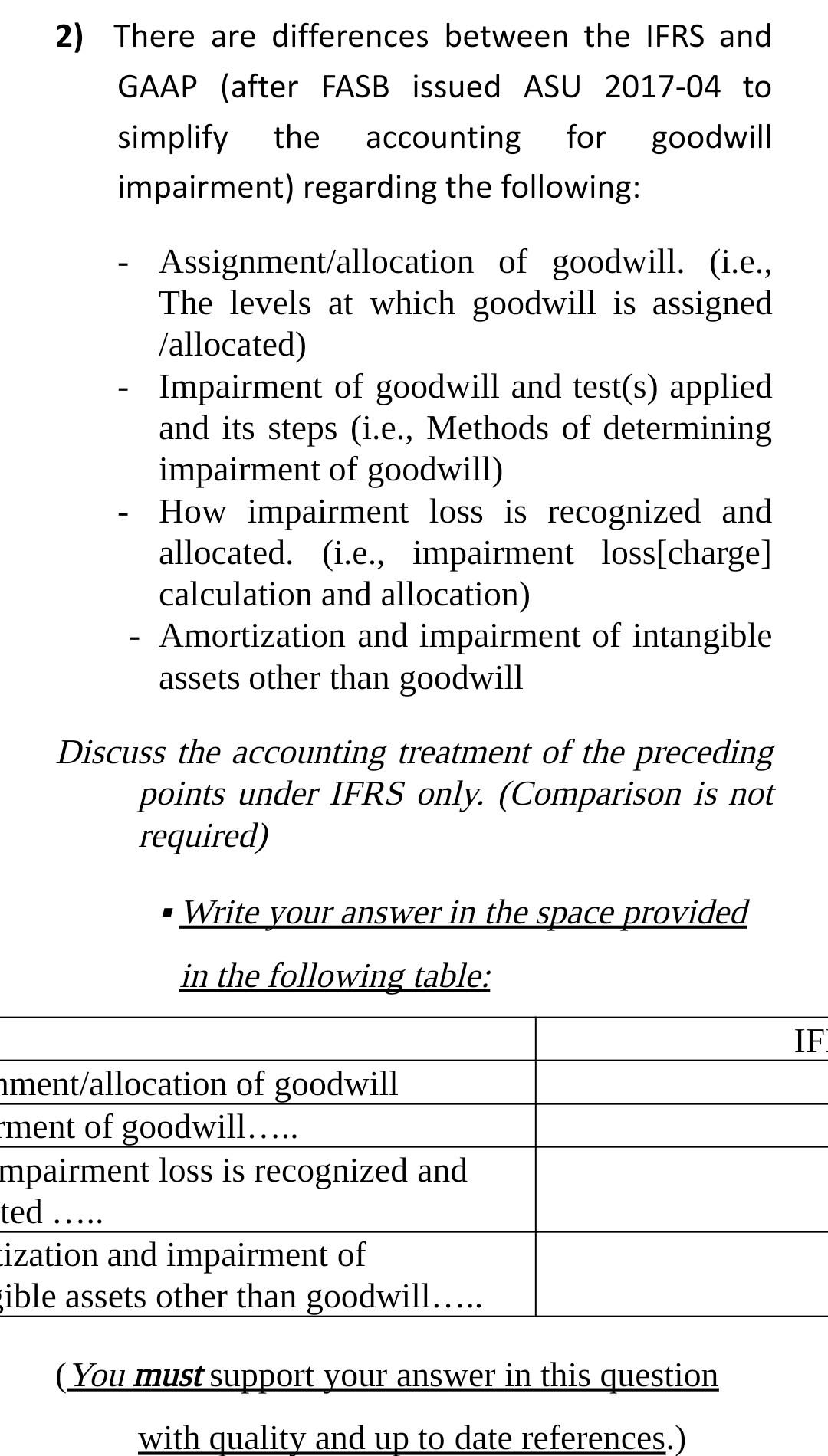

2) There are differences between the IFRS and GAAP (after FASB issued ASU 2017-04 to simplify the accounting for goodwill impairment) regarding the following: Assignment/allocation of goodwill. (i.e., The levels at which goodwill is assigned /allocated) Impairment of goodwill and test(s) applied and its steps (i.e., Methods of determining impairment of goodwill) How impairment loss is recognized and allocated. (i.e., impairment loss[charge] calculation and allocation) - Amortization and impairment of intangible assets other than goodwill Discuss the accounting treatment of the preceding points under IFRS only. (Comparison is not required) Write your answer in the space provided in the following table: IF ment/allocation of goodwill -ment of goodwill..... mpairment loss is recognized and ted ..... cization and impairment of ible assets other than goodwill..... (You must support your answer in this question with quality and up to date references.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts