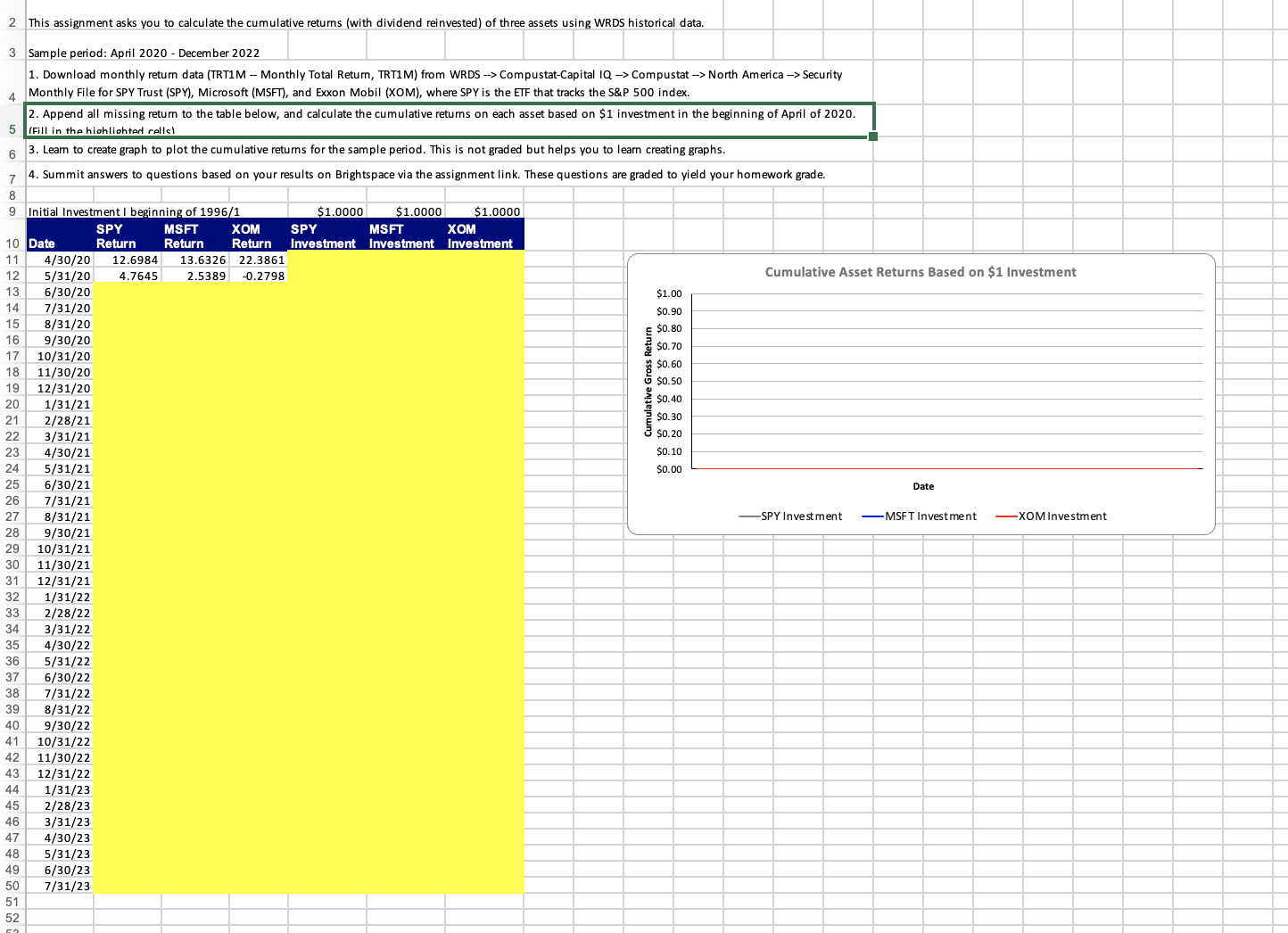

Question: 2 This assignment asks you to calculate the cumulative returns (with dividend reinvested) of three assets using WRDS historical data. 3 Sample period: April 2020

2 This assignment asks you to calculate the cumulative returns (with dividend reinvested) of three assets using WRDS historical data. 3 Sample period: April 2020 - December 2022 1. Download monthly return data (TRT1M - Monthly Total Return, TRT1M) from WRDS Compustat-Capital IQ Compustat North America > Security 4 Monthly File for SPY Trust (SPY), Microsoft (MSFT), and Exxon Mobil (XOM), where SPY is the ETF that tracks the S\&P 500 index. 2. Append all missing return to the table below, and calculate the cumulative returns on each asset based on $1 investment in the beginning of April of 2020 . (Fill in the hiohliohtert rells) 3. Learn to create graph to plot the cumulative returns for the sample period. This is not graded but helps you to learn creating graphs. 4. Summit answers to questions based on your results on Brightspace via the assignment link. These questions are graded to yield your homework grade. 8 9 Date SPY 11 4/30/20 Return MSFT 5/31/20 12.6984 Return XOM SPY 6/30/20 4.7645 13.6326 Return MSFT 7/31/20 8/31/20 9/30/20 10/31/20 11/30/20 12/31/20 1/31/21 2/28/21 3/31/21 4/30/21 5/31/21 6/30/21 7/31/21 8/31/21 9/30/21 10/31/21 11/30/21 12/31/21 1/31/22 2/28/22 3/31/22 4/30/22 5/31/22 6/30/22 7/31/22 8/31/22 9/30/22 10/31/22 11/30/22 12/31/22 1/31/23 2/28/23 3/31/23 4/30/23 5/31/23 6/30/23 7/31/23 XOM Investment 98 Cumulative Asset Returns Based on \$1 Investment $1.00 $0.90 $0.80 $0.70 $0.60 $0.50 $0.10 $0.00 Date SPY Investment -MSFT Investment XOM Investment 51 52 \begin{tabular}{l|l|l} \hline & \\ \hline & & \\ \hline \end{tabular} \begin{tabular}{|l|l|l|l|l|l|} \hline & & & & & \\ \hline & & & & & \\ \hline & & & & & \\ \hline & & & & & \\ \hline & & & & & \\ \hline & & & & & \\ \hline & & & & & \\ \hline & & & & & \\ \hline & & & & & \\ \hline & & & & \\ \hline & & & & & \\ \hline & & & & & \\ \hline & & & & & \\ \hline & & & & & \\ \hline \end{tabular} \begin{tabular}{|c|} \hline \\ \hline \end{tabular} 2 This assignment asks you to calculate the cumulative returns (with dividend reinvested) of three assets using WRDS historical data. 3 Sample period: April 2020 - December 2022 1. Download monthly return data (TRT1M - Monthly Total Return, TRT1M) from WRDS Compustat-Capital IQ Compustat North America > Security 4 Monthly File for SPY Trust (SPY), Microsoft (MSFT), and Exxon Mobil (XOM), where SPY is the ETF that tracks the S\&P 500 index. 2. Append all missing return to the table below, and calculate the cumulative returns on each asset based on $1 investment in the beginning of April of 2020 . (Fill in the hiohliohtert rells) 3. Learn to create graph to plot the cumulative returns for the sample period. This is not graded but helps you to learn creating graphs. 4. Summit answers to questions based on your results on Brightspace via the assignment link. These questions are graded to yield your homework grade. 8 9 Date SPY 11 4/30/20 Return MSFT 5/31/20 12.6984 Return XOM SPY 6/30/20 4.7645 13.6326 Return MSFT 7/31/20 8/31/20 9/30/20 10/31/20 11/30/20 12/31/20 1/31/21 2/28/21 3/31/21 4/30/21 5/31/21 6/30/21 7/31/21 8/31/21 9/30/21 10/31/21 11/30/21 12/31/21 1/31/22 2/28/22 3/31/22 4/30/22 5/31/22 6/30/22 7/31/22 8/31/22 9/30/22 10/31/22 11/30/22 12/31/22 1/31/23 2/28/23 3/31/23 4/30/23 5/31/23 6/30/23 7/31/23 XOM Investment 98 Cumulative Asset Returns Based on \$1 Investment $1.00 $0.90 $0.80 $0.70 $0.60 $0.50 $0.10 $0.00 Date SPY Investment -MSFT Investment XOM Investment 51 52 \begin{tabular}{l|l|l} \hline & \\ \hline & & \\ \hline \end{tabular} \begin{tabular}{|l|l|l|l|l|l|} \hline & & & & & \\ \hline & & & & & \\ \hline & & & & & \\ \hline & & & & & \\ \hline & & & & & \\ \hline & & & & & \\ \hline & & & & & \\ \hline & & & & & \\ \hline & & & & & \\ \hline & & & & \\ \hline & & & & & \\ \hline & & & & & \\ \hline & & & & & \\ \hline & & & & & \\ \hline \end{tabular} \begin{tabular}{|c|} \hline \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts