Question: 2. This is two period American put option model. Underlying asset price at current time is $100 and u(up factor in the binomial tree) is

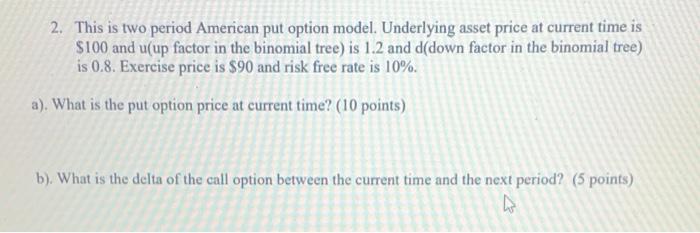

2. This is two period American put option model. Underlying asset price at current time is $100 and u(up factor in the binomial tree) is 1.2 and d(down factor in the binomial tree) is 0.8. Exercise price is $90 and risk free rate is 10%. a). What is the put option price at current time? (10 points) b). What is the delta of the call option between the current time and the next period? (5 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts