Question: 2) This question will build on the example from the last assignment. Suppose that you are a clothing brand interested in selling t-shirts in China.

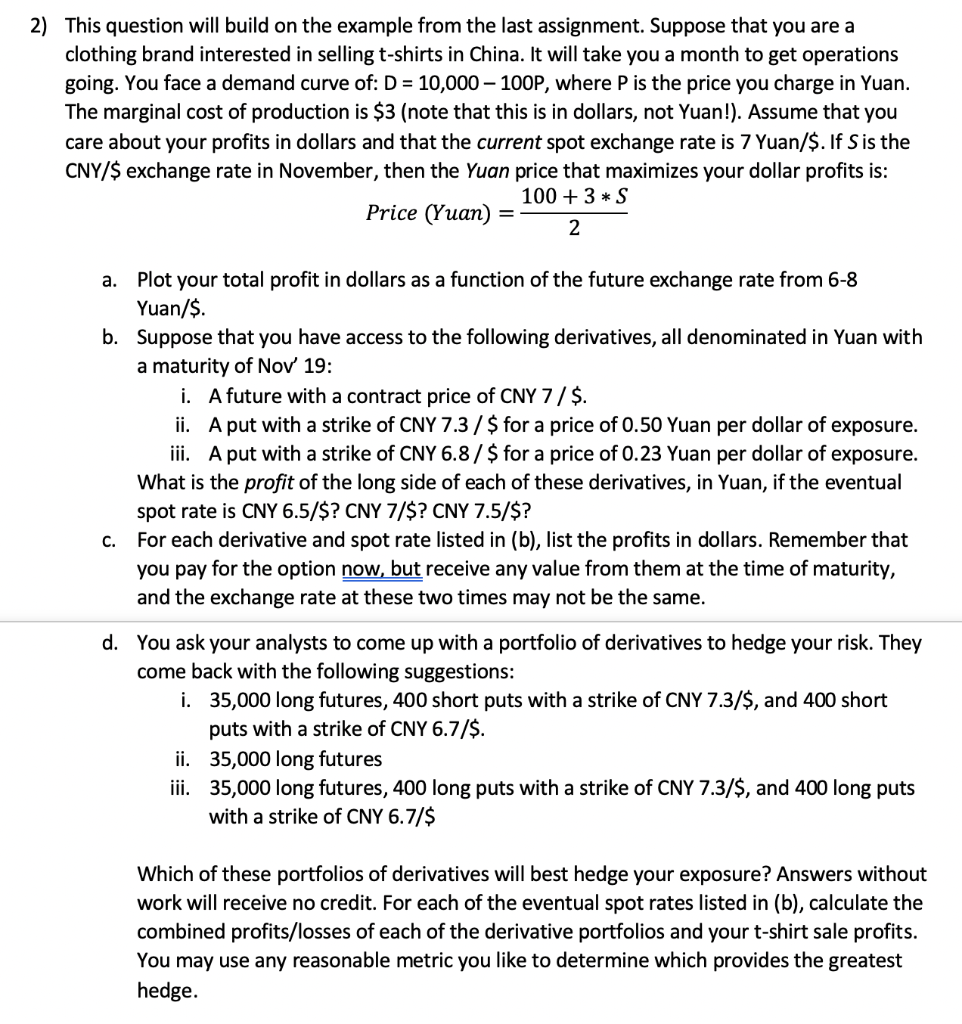

2) This question will build on the example from the last assignment. Suppose that you are a clothing brand interested in selling t-shirts in China. It will take you a month to get operations going. You face a demand curve of: D = 10,000 - 100P, where P is the price you charge in Yuan. The marginal cost of production is $3 (note that this is in dollars, not Yuan!). Assume that you care about your profits in dollars and that the current spot exchange rate is 7 Yuan/$. If Sis the CNY/$ exchange rate in November, then the Yuan price that maximizes your dollar profits is: Price (Yuan) - 100 + 3 *S a. Plot your total profit in dollars as a function of the future exchange rate from 6-8 Yuan/$. b. Suppose that you have access to the following derivatives, all denominated in Yuan with a maturity of Nov 19: i. A future with a contract price of CNY 7/$. ii. A put with a strike of CNY 7.3 / $ for a price of 0.50 Yuan per dollar of exposure. iii. A put with a strike of CNY 6.8/$ for a price of 0.23 Yuan per dollar of exposure. What is the profit of the long side of each of these derivatives, in Yuan, if the eventual spot rate is CNY 6.5/$? CNY 7/$? CNY 7.5/$? C. For each derivative and spot rate listed in (b), list the profits in dollars. Remember that you pay for the option now, but receive any value from them at the time of maturity, and the exchange rate at these two times may not be the same. d. You ask your analysts to come up with a portfolio of derivatives to hedge your risk. They come back with the following suggestions: i. 35,000 long futures, 400 short puts with a strike of CNY 7.3/$, and 400 short puts with a strike of CNY 6.7/$. ii. 35,000 long futures iii. 35,000 long futures, 400 long puts with a strike of CNY 7.3/$, and 400 long puts with a strike of CNY 6.7/$ Which of these portfolios of derivatives will best hedge your exposure? Answers without work will receive no credit. For each of the eventual spot rates listed in (b), calculate the combined profits/losses of each of the derivative portfolios and your t-shirt sale profits. You may use any reasonable metric you like to determine which provides the greatest hedge. 2) This question will build on the example from the last assignment. Suppose that you are a clothing brand interested in selling t-shirts in China. It will take you a month to get operations going. You face a demand curve of: D = 10,000 - 100P, where P is the price you charge in Yuan. The marginal cost of production is $3 (note that this is in dollars, not Yuan!). Assume that you care about your profits in dollars and that the current spot exchange rate is 7 Yuan/$. If Sis the CNY/$ exchange rate in November, then the Yuan price that maximizes your dollar profits is: Price (Yuan) - 100 + 3 *S a. Plot your total profit in dollars as a function of the future exchange rate from 6-8 Yuan/$. b. Suppose that you have access to the following derivatives, all denominated in Yuan with a maturity of Nov 19: i. A future with a contract price of CNY 7/$. ii. A put with a strike of CNY 7.3 / $ for a price of 0.50 Yuan per dollar of exposure. iii. A put with a strike of CNY 6.8/$ for a price of 0.23 Yuan per dollar of exposure. What is the profit of the long side of each of these derivatives, in Yuan, if the eventual spot rate is CNY 6.5/$? CNY 7/$? CNY 7.5/$? C. For each derivative and spot rate listed in (b), list the profits in dollars. Remember that you pay for the option now, but receive any value from them at the time of maturity, and the exchange rate at these two times may not be the same. d. You ask your analysts to come up with a portfolio of derivatives to hedge your risk. They come back with the following suggestions: i. 35,000 long futures, 400 short puts with a strike of CNY 7.3/$, and 400 short puts with a strike of CNY 6.7/$. ii. 35,000 long futures iii. 35,000 long futures, 400 long puts with a strike of CNY 7.3/$, and 400 long puts with a strike of CNY 6.7/$ Which of these portfolios of derivatives will best hedge your exposure? Answers without work will receive no credit. For each of the eventual spot rates listed in (b), calculate the combined profits/losses of each of the derivative portfolios and your t-shirt sale profits. You may use any reasonable metric you like to determine which provides the greatest hedge

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts