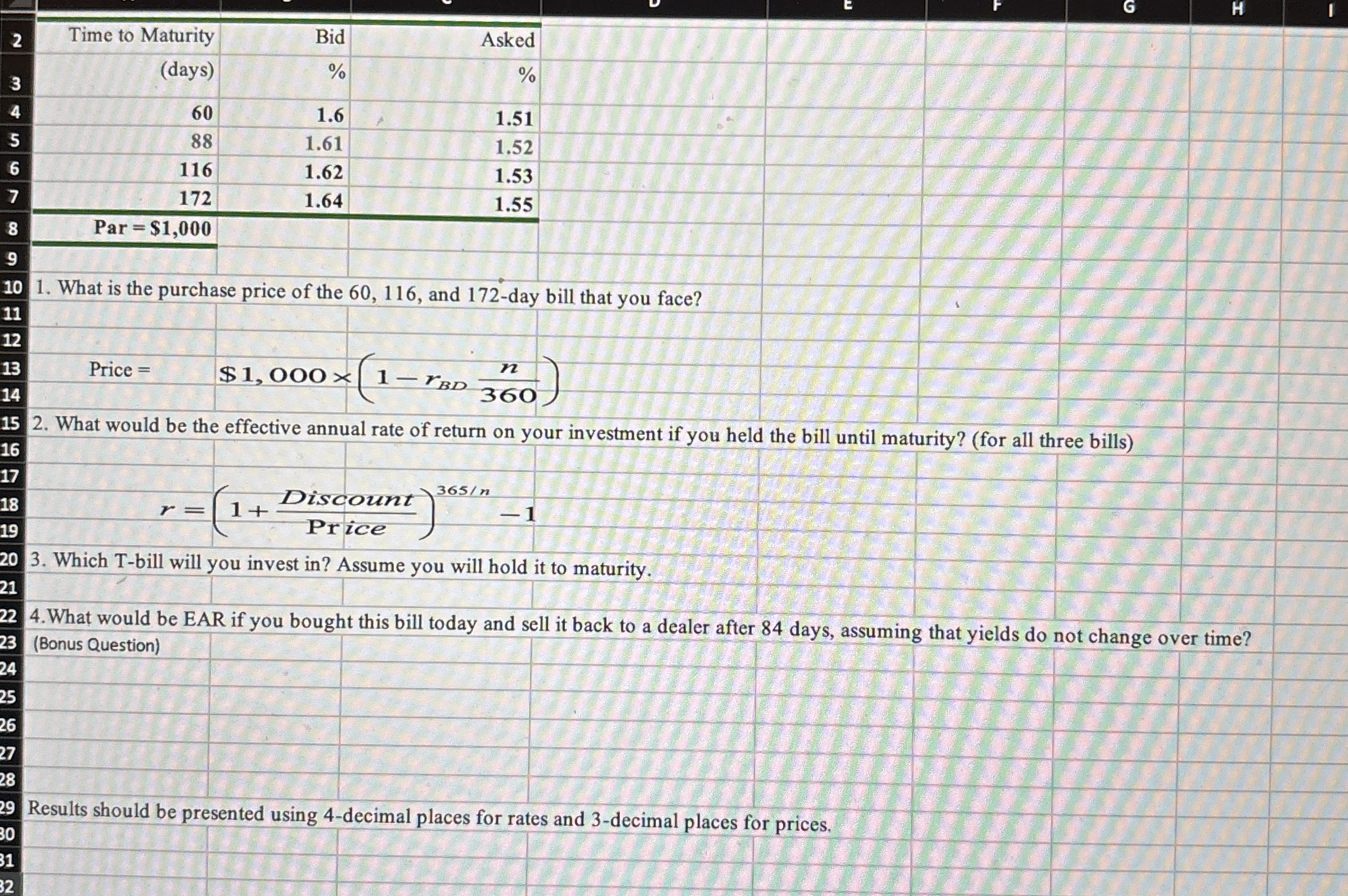

Question: 2 Time to Maturity ( days ) Bid Asked 3 4 5 6 7 table [ [ 8 , Par = $ 1 ,

Time to Maturity

days

Bid

Asked

tablePar $

What is the purchase price of the and day bill that you face?

Price $

What would be the effective annual rate of return on your investment if you held the bill until maturity? for all three bills

Which Tbill will you invest in Assume you will hold it to maturity.

What would be EAR if you bought this bill today and sell it back to a dealer after days, assuming that yields do not change over time?

Bonus Question

Results should be presented using decimal places for rates and decimal places for prices.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock