Question: .. 2. (Total 2 points, one point for each) Suppose that Ms. Chung is bullish on Green Cross stock. Its current market price is $20

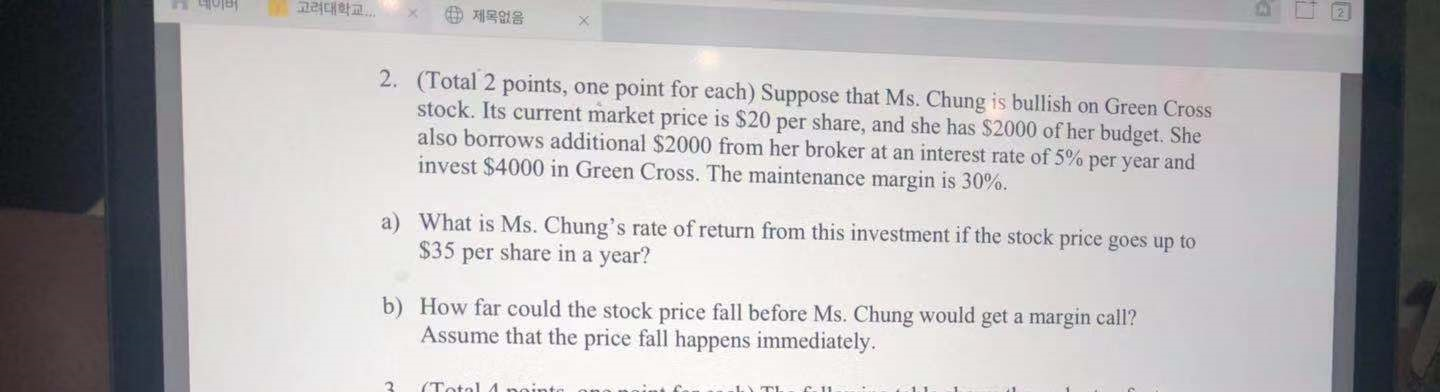

.. 2. (Total 2 points, one point for each) Suppose that Ms. Chung is bullish on Green Cross stock. Its current market price is $20 per share, and she has $2000 of her budget. She also borrows additional $2000 from her broker at an interest rate of 5% per year and invest $4000 in Green Cross. The maintenance margin is 30%. a) What is Ms. Chung's rate of return from this investment if the stock price goes up to $35 per share in a year? b) How far could the stock price fall before Ms. Chung would get a margin call? Assume that the price fall happens immediately. (Totol 4

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts