Question: 2. Transaction Exposure: (a) Do nothing: U$ Payable in 1 year: 500M = $4,032,258 (you do the calculation) if then spot rate =- or 500M

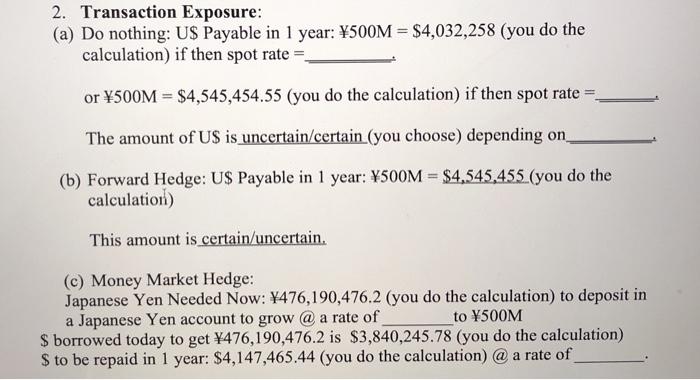

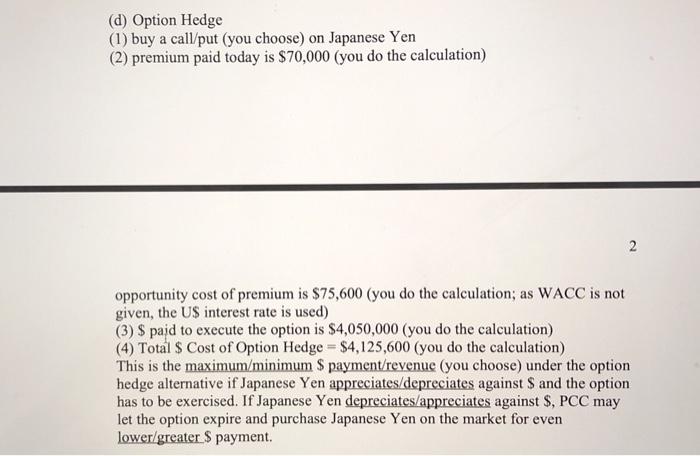

2. Transaction Exposure: (a) Do nothing: U$ Payable in 1 year: 500M = $4,032,258 (you do the calculation) if then spot rate =- or 500M = $4,545,454.55 (you do the calculation) if then spot rate =- The amount of US is uncertain certain (you choose) depending on (b) Forward Hedge: U$ Payable in 1 year: 500M = $4,545,455 (you do the calculation) This amount is certain uncertain. (c) Money Market Hedge: Japanese Yen Needed Now: 476,190,476.2 (you do the calculation) to deposit in a Japanese Yen account to grow @a rate of to Y500M $ borrowed today to get 476,190,476.2 is $3,840,245.78 (you do the calculation) $ to be repaid in 1 year: $4,147,465.44 (you do the calculation) @ a rate of (d) Option Hedge (1) buy a call/put (you choose) on Japanese Yen (2) premium paid today is $70,000 (you do the calculation) 2 opportunity cost of premium is $75,600 (you do the calculation; as WACC is not given, the U$ interest rate is used) (3) $ paid to execute the option is $4,050,000 (you do the calculation) (4) Total $ Cost of Option Hedge = $4,125,600 (you do the calculation) This is the maximum/minimum $ payment/revenue (you choose) under the option hedge alternative if Japanese Yen appreciates/depreciates against S and the option has to be exercised. If Japanese Yen depreciates/appreciates against $, PCC may let the option expire and purchase Japanese Yen on the market for even lower/greater $ payment. 2. Transaction Exposure: (a) Do nothing: U$ Payable in 1 year: 500M = $4,032,258 (you do the calculation) if then spot rate =- or 500M = $4,545,454.55 (you do the calculation) if then spot rate =- The amount of US is uncertain certain (you choose) depending on (b) Forward Hedge: U$ Payable in 1 year: 500M = $4,545,455 (you do the calculation) This amount is certain uncertain. (c) Money Market Hedge: Japanese Yen Needed Now: 476,190,476.2 (you do the calculation) to deposit in a Japanese Yen account to grow @a rate of to Y500M $ borrowed today to get 476,190,476.2 is $3,840,245.78 (you do the calculation) $ to be repaid in 1 year: $4,147,465.44 (you do the calculation) @ a rate of (d) Option Hedge (1) buy a call/put (you choose) on Japanese Yen (2) premium paid today is $70,000 (you do the calculation) 2 opportunity cost of premium is $75,600 (you do the calculation; as WACC is not given, the U$ interest rate is used) (3) $ paid to execute the option is $4,050,000 (you do the calculation) (4) Total $ Cost of Option Hedge = $4,125,600 (you do the calculation) This is the maximum/minimum $ payment/revenue (you choose) under the option hedge alternative if Japanese Yen appreciates/depreciates against S and the option has to be exercised. If Japanese Yen depreciates/appreciates against $, PCC may let the option expire and purchase Japanese Yen on the market for even lower/greater $ payment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts