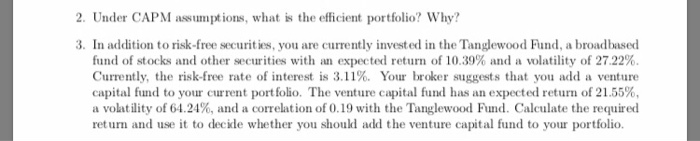

Question: 2. Under CAPM assumptions, what is the efficient portfolio? Why? 3. In addition to risk-free securities, you are currently invested in the Tanglewood Fund, a

2. Under CAPM assumptions, what is the efficient portfolio? Why? 3. In addition to risk-free securities, you are currently invested in the Tanglewood Fund, a broadbased fund of stocks and other securities with an expected return of 10.39% and a volatility of 27.22%. Currently, the risk-free rate of interest is 3.11%. Your broker suggests that you add a venture capital fund to your current portfolio. The venture capital fund has an expected return of 21.55%. a volatility of 64.24% and a correlation of 0.19 with the Tanglewood Fund. Calculate the required return and use it to decile whether you should add the venture capital fund to your portfolio. 2. Under CAPM assumptions, what is the efficient portfolio? Why? 3. In addition to risk-free securities, you are currently invested in the Tanglewood Fund, a broadbased fund of stocks and other securities with an expected return of 10.39% and a volatility of 27.22%. Currently, the risk-free rate of interest is 3.11%. Your broker suggests that you add a venture capital fund to your current portfolio. The venture capital fund has an expected return of 21.55%. a volatility of 64.24% and a correlation of 0.19 with the Tanglewood Fund. Calculate the required return and use it to decile whether you should add the venture capital fund to your portfolio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts