Question: 2. Understanding the difference between open-end and closed-end funds Categorizing Mutual Funds For each of the following statements regarding mutual funds, indicate whether it is

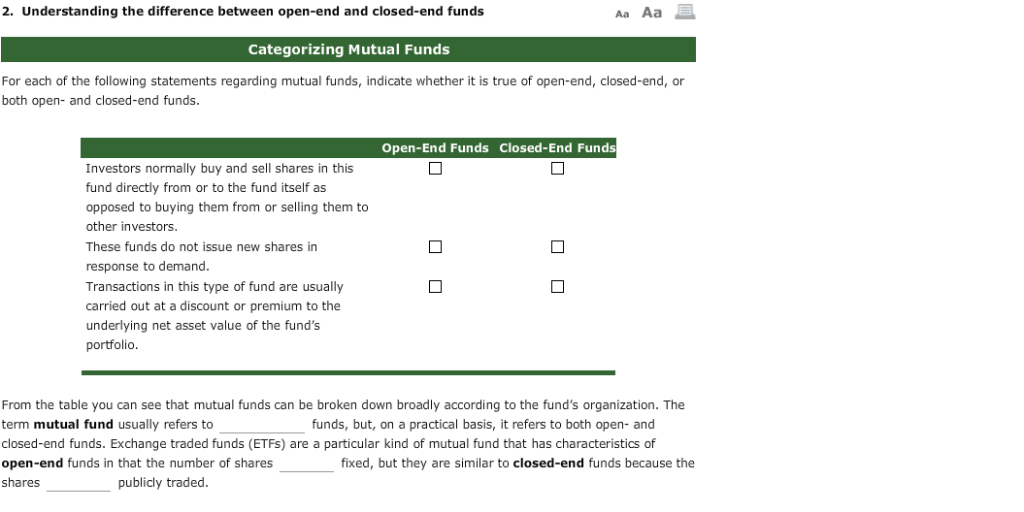

2. Understanding the difference between open-end and closed-end funds Categorizing Mutual Funds For each of the following statements regarding mutual funds, indicate whether it is true of open-end, closed-end, or both open- and closed-end funds. Open-End Funds Closed-End Fund Investors normally buy and sell shares in this fund directly from or to the fund itself as opposed to buying them from or selling them to other investors. These funds do not issue new shares in response to demand. Transactions in this type of fund are usually carried out at a discount or premium to the underlying net asset value of the fund's portfolio. From the table you can see that mutual funds can be broken down broadly according to the fund's organization. The term mutual fund usually refers to closed-end funds. Exchange traded funds (ETFs) are a particular kind of mutual fund that has characteristics of open-end funds in that the number of shares shares funds, but, on a practical basis, it refers to both open- and fixed, but they are similar to closed-end funds because the publicly traded

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts