Question: 2. Use the following average returns and standard deviations for IWM and IVV to compute the following: (12 points) Average Return Standard Deviation Fund A/Fund

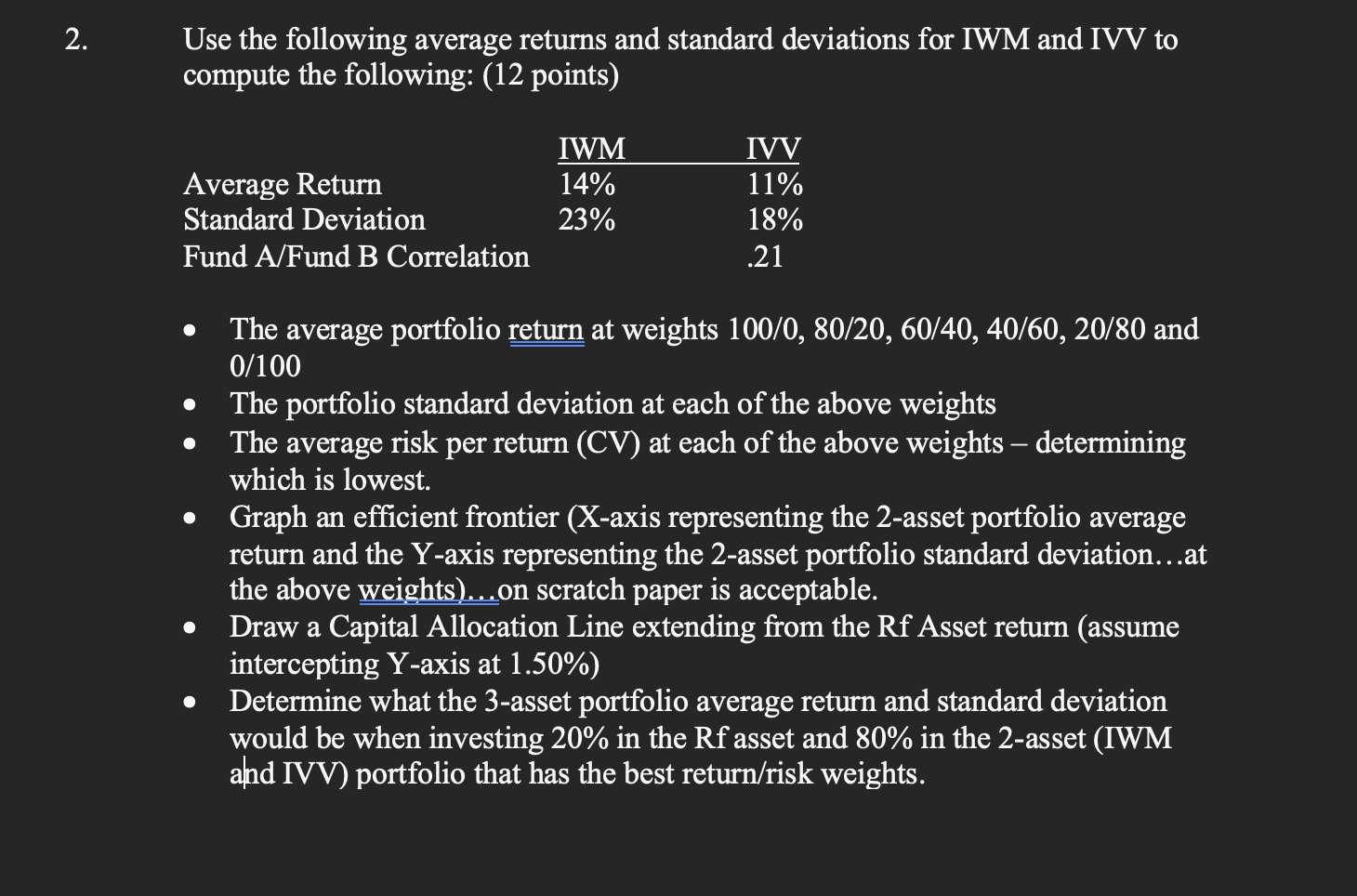

2. Use the following average returns and standard deviations for IWM and IVV to compute the following: (12 points) Average Return Standard Deviation Fund A/Fund B Correlation IWM 14% 23% IVV 11% 18% .21 O The average portfolio return at weights 100/0, 80/20, 60/40, 40/60, 20/80 and 0/100 The portfolio standard deviation at each of the above weights The average risk per return (CV) at each of the above weights determining which is lowest. Graph an efficient frontier (X-axis representing the 2-asset portfolio average return and the Y-axis representing the 2-asset portfolio standard deviation...at the above weights)...on scratch paper is acceptable. Draw a Capital Allocation Line extending from the Rf Asset return (assume intercepting Y-axis at 1.50%) Determine what the 3-asset portfolio average return and standard deviation would be when investing 20% in the Rf asset and 80% in the 2-asset (IWM and IVV) portfolio that has the best return/risk weights. O 2. Use the following average returns and standard deviations for IWM and IVV to compute the following: (12 points) Average Return Standard Deviation Fund A/Fund B Correlation IWM 14% 23% IVV 11% 18% .21 O The average portfolio return at weights 100/0, 80/20, 60/40, 40/60, 20/80 and 0/100 The portfolio standard deviation at each of the above weights The average risk per return (CV) at each of the above weights determining which is lowest. Graph an efficient frontier (X-axis representing the 2-asset portfolio average return and the Y-axis representing the 2-asset portfolio standard deviation...at the above weights)...on scratch paper is acceptable. Draw a Capital Allocation Line extending from the Rf Asset return (assume intercepting Y-axis at 1.50%) Determine what the 3-asset portfolio average return and standard deviation would be when investing 20% in the Rf asset and 80% in the 2-asset (IWM and IVV) portfolio that has the best return/risk weights. O

Step by Step Solution

There are 3 Steps involved in it

To solve this problem lets break it down stepbystep Step 1 Calculate the Average Portfolio Return The average return of a portfolio is calculated as R... View full answer

Get step-by-step solutions from verified subject matter experts