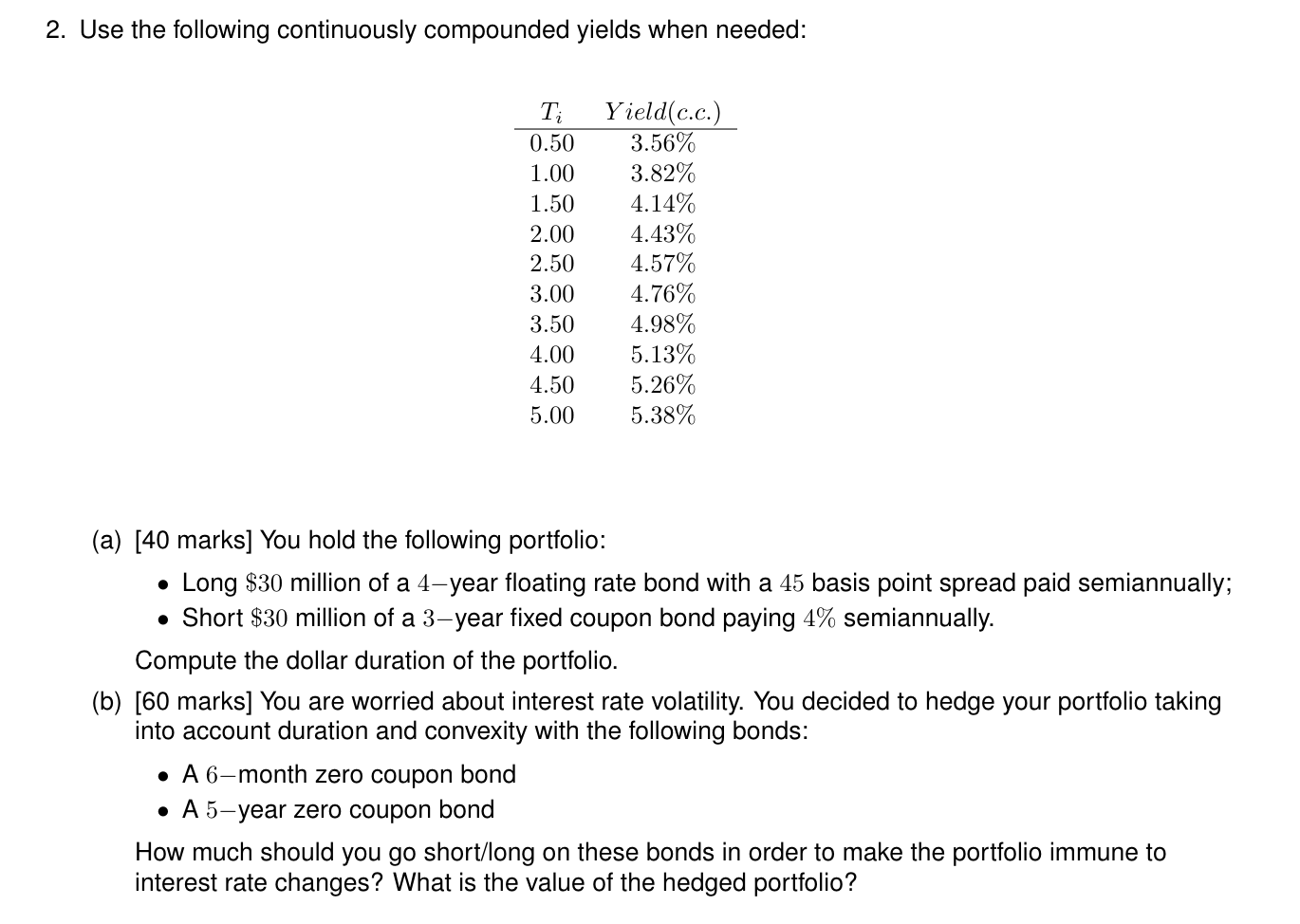

Question: 2. Use the following continuously compounded yields when needed: Ti 0.50 1.00 1.50 2.00 2.50 3.00 3.50 4.00 4.50 5.00 Yield(c.c.) 3.56% 3.82% 4.14% 4.43%

2. Use the following continuously compounded yields when needed: Ti 0.50 1.00 1.50 2.00 2.50 3.00 3.50 4.00 4.50 5.00 Yield(c.c.) 3.56% 3.82% 4.14% 4.43% 4.57% 4.76% 4.98% 5.13% 5.26% 5.38% . (a) [40 marks] You hold the following portfolio: Long $30 million of a 4-year floating rate bond with a 45 basis point spread paid semiannually; Short $30 million of a 3-year fixed coupon bond paying 4% semiannually. Compute the dollar duration of the portfolio. (b) [60 marks] You are worried about interest rate volatility. You decided to hedge your portfolio taking into account duration and convexity with the following bonds: A 6-month zero coupon bond A 5-year zero coupon bond How much should you go short/long on these bonds in order to make the portfolio immune to interest rate changes? What is the value of the hedged portfolio? 2. Use the following continuously compounded yields when needed: Ti 0.50 1.00 1.50 2.00 2.50 3.00 3.50 4.00 4.50 5.00 Yield(c.c.) 3.56% 3.82% 4.14% 4.43% 4.57% 4.76% 4.98% 5.13% 5.26% 5.38% . (a) [40 marks] You hold the following portfolio: Long $30 million of a 4-year floating rate bond with a 45 basis point spread paid semiannually; Short $30 million of a 3-year fixed coupon bond paying 4% semiannually. Compute the dollar duration of the portfolio. (b) [60 marks] You are worried about interest rate volatility. You decided to hedge your portfolio taking into account duration and convexity with the following bonds: A 6-month zero coupon bond A 5-year zero coupon bond How much should you go short/long on these bonds in order to make the portfolio immune to interest rate changes? What is the value of the hedged portfolio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts