Question: 2. Use this example for the following questions: A team purchases a computer for $500 which they expect to sell in 5 years for

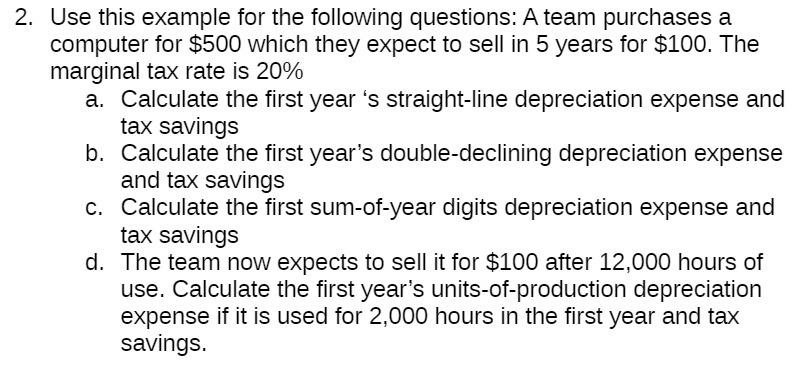

2. Use this example for the following questions: A team purchases a computer for $500 which they expect to sell in 5 years for $100. The marginal tax rate is 20% a. Calculate the first year 's straight-line depreciation expense and tax savings b. Calculate the first year's double-declining depreciation expense and tax savings c. Calculate the first sum-of-year digits depreciation expense and tax savings d. The team now expects to sell it for $100 after 12,000 hours of use. Calculate the first year's units-of-production depreciation expense if it is used for 2,000 hours in the first year and tax savings.

Step by Step Solution

3.44 Rating (160 Votes )

There are 3 Steps involved in it

a Straightline depreciation expense The straightline depreciation expense is calculated by dividing the cost of the computer by its useful life In thi... View full answer

Get step-by-step solutions from verified subject matter experts