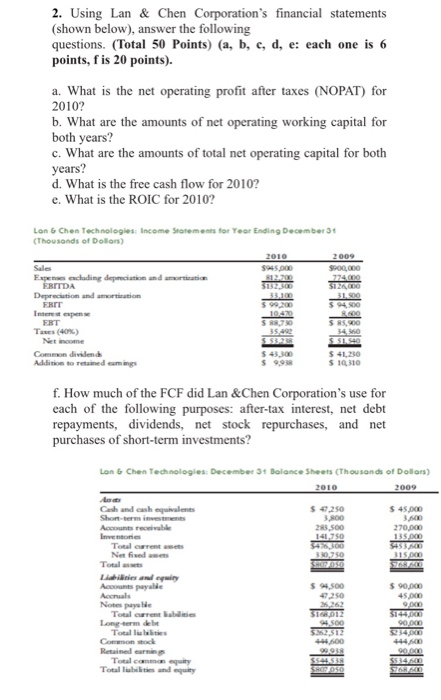

Question: 2. Using Lan & Chen Corporation's financial statements (shown below), answer the following questions. (Total 50 Points) (a, b, c, d, e: each one is

2. Using Lan & Chen Corporation's financial statements (shown below), answer the following questions. (Total 50 Points) (a, b, c, d, e: each one is 6 points, f is 20 points). a. What is the net operating profit after taxes (NOPAT) for 2010? b. What are the amounts of net operating working capital for both years? c. What are the amounts of total net operating capital for both years? d. What is the free cash flow for 2010? e. What is the ROIC for 2010? Lan Chen Technologies: Income Statements for Year Ending December 31 (Thousands of Dolors) 2010 2009 Sales $945.000 S200,000 Exaclading depreciation and writion 774.000 EBITDA 3132300 Depreciation and motion FBr 599,200 $94.500 Interest expense ERT $ 88,730 S 85,00 Taxes (40%) 354 34 360 SSID Common dividende $43.00 Addition to retained emings $ 10,310 $ 41,230 f. How much of the FCF did Lan &Chen Corporation's use for each of the following purposes: after-tax interest, net debt repayments, dividends, net stock repurchases, and net purchases of short-term investments? Lon 6 Chen Technologies: December 34 Balance Sheets (Thousands of Dollars) 2010 2009 $ 47,250 3.800 283,500 141.750 3.750 $ 45.00 3.00 270,000 135.000 5453 315.000 Cash and cash equivalent Short-term investments Accounts receivable Investors Total Netfied Tuale Ini adity A pale Accruals Note pale Total current abilities Long-term dele Total Bible Common stock Relar Total city Total liabilities and $ 94,500 $ 90,000 45 3162012 94.500 $33,312 44100 $144 90.000 $234.00 S540S SOROSO $534 MD SA

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts