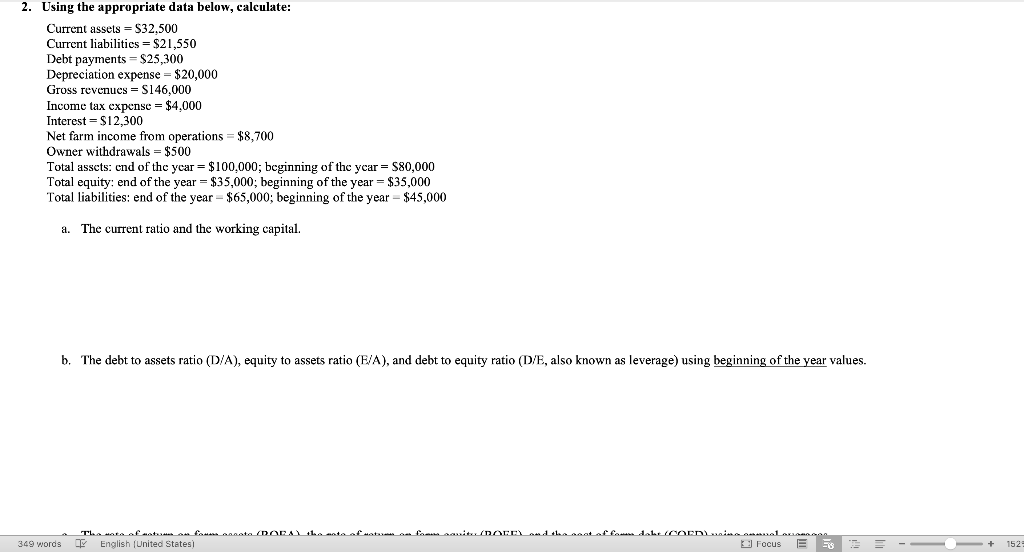

Question: 2. Using the appropriate data below, calculate: Current assets = $32,500 Current liabilities = $21,550 Debt payments = $25,300 Depreciation expense = $20,000 Gross revenues-S146,000

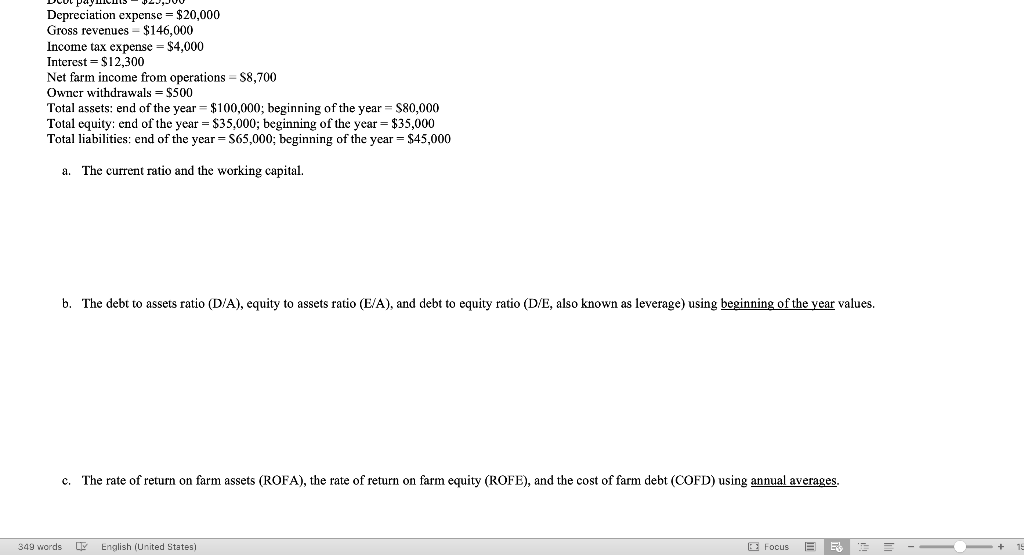

2. Using the appropriate data below, calculate: Current assets = $32,500 Current liabilities = $21,550 Debt payments = $25,300 Depreciation expense = $20,000 Gross revenues-S146,000 Income tax expense = $4.000 Interest = $12,300 Net farm income from operations = $8,700 Owner withdrawals = $500 Total assets: end of the year = $100.000; beginning of the year = 580,000 Total equity: end of the year = $35,000; beginning of the year = $35,000 Total liabilities: end of the year - $65,000; beginning of the year - $45,000 a. The current ratio and the working capital. b. The debt to assets ratio (D/A), equity to assets ratio (F/A), and debt to equity ratio (D/E, also known as leverage) using beginning of the year values. ET rEr nE 349 words TI English (United States) Focus + 152 Depreciation expense = $20,000 Gross revenues - $146,000 Income tax expense - $4,000 Interest = $12,300 Net farm income from operations = $8,700 Owner withdrawals = $500 Total assets: end of the year = $100,000; beginning of the year = $80,000 Total equity: end of the year = $35.000; beginning of the year = $35,000 Total liabilities: end of the year=S65,000; beginning of the year = $45,000 a. The current ratio and the working capital. b. The debt to assets ratio (D/A), equity to assets ratio (E/A), and debt to equity ratio (D/E, also known as leverage) using beginning of the year values. c. The rate of return on farm assets (ROFA), the rate of return on farm equity (ROFE), and the cost of farm debt (COFD) using annual averages. 349 words LE English (United States) Focus E ERS 2. Using the appropriate data below, calculate: Current assets = $32,500 Current liabilities = $21,550 Debt payments = $25,300 Depreciation expense = $20,000 Gross revenues-S146,000 Income tax expense = $4.000 Interest = $12,300 Net farm income from operations = $8,700 Owner withdrawals = $500 Total assets: end of the year = $100.000; beginning of the year = 580,000 Total equity: end of the year = $35,000; beginning of the year = $35,000 Total liabilities: end of the year - $65,000; beginning of the year - $45,000 a. The current ratio and the working capital. b. The debt to assets ratio (D/A), equity to assets ratio (F/A), and debt to equity ratio (D/E, also known as leverage) using beginning of the year values. ET rEr nE 349 words TI English (United States) Focus + 152 Depreciation expense = $20,000 Gross revenues - $146,000 Income tax expense - $4,000 Interest = $12,300 Net farm income from operations = $8,700 Owner withdrawals = $500 Total assets: end of the year = $100,000; beginning of the year = $80,000 Total equity: end of the year = $35.000; beginning of the year = $35,000 Total liabilities: end of the year=S65,000; beginning of the year = $45,000 a. The current ratio and the working capital. b. The debt to assets ratio (D/A), equity to assets ratio (E/A), and debt to equity ratio (D/E, also known as leverage) using beginning of the year values. c. The rate of return on farm assets (ROFA), the rate of return on farm equity (ROFE), and the cost of farm debt (COFD) using annual averages. 349 words LE English (United States) Focus E ERS

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts