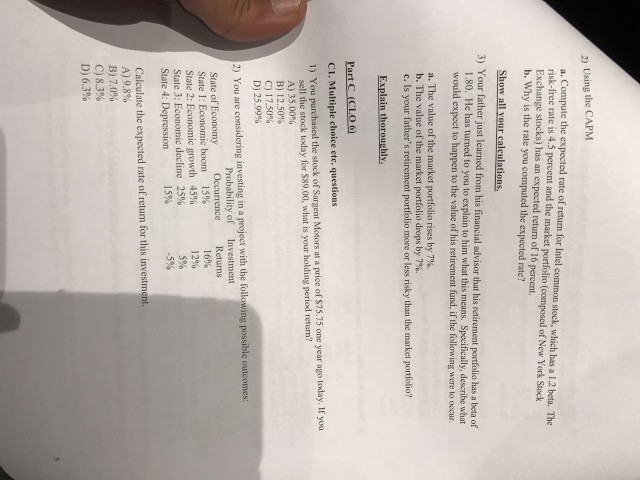

Question: 2) Using the CAPM a. Compute the expected rate of return for Intel common stock, which has a 1.2 beta. The risk-free rate is 4.5

2) Using the CAPM a. Compute the expected rate of return for Intel common stock, which has a 1.2 beta. The risk-free rate is 4.5 percent and the market portfolio (composed of New York Stock Exchange stocks) has an expected return of 16 percent. b. Why is the rate you computed the expected rate? Show all your calculations. 3) Your father just learned from his financial advisor that his retirement portfolio has a beta of 1.80. He has turned to you to explain to him what this means. Specifically, describe what would expect to happen to the value of his retirement fund, if the following were to occur a. The value of the market portfolio rises by 7%. b. The value of the market portfolio drops by 7%. c. Is your father's retirement portfolio more or less risky than the market portfolio? Explain thoroughlv Part C (CLO 6 CI. Multiple choice ete. questions 1) You purchased the stock of Sargent Motors at a price of S75.75 one year ago today. If yoru sell the stock today for $89.00, what is your holding period return? A) 35.00% B) 12.50% C) 17.50% D) 25.99% 2) You are considering investing in a project with the following possible outcomes Probability of Investment State of Economy Occurrence Retuns State 1: Economic boom 15% State 2: Economic growth 45% 16% 12% 5% 25% State 3: Economic decline State 4: Depression Calculate the expected rate of return for this investment A) 9.8% B) 7.0% C) 8.3% D) 6.3%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts