Question: 2. Using the CME Group prices, evaluate the 3 month price (Fo) for arbitrage in the EUR/USD futures contract. Assume the risk-free rate in the

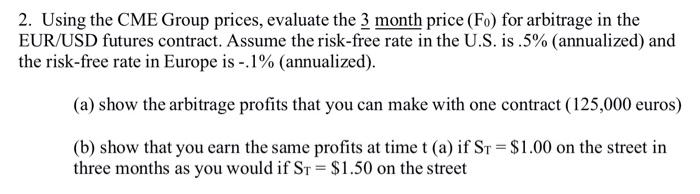

2. Using the CME Group prices, evaluate the 3 month price (Fo) for arbitrage in the EUR/USD futures contract. Assume the risk-free rate in the U.S. is.5% (annualized) and the risk-free rate in Europe is -.1% (annualized). (a) show the arbitrage profits that you can make with one contract (125,000 euros) (b) show that you earn the same profits at time t(a) if St = $1.00 on the street in three months as you would if St = $1.50 on the street

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts