Question: 2. Using the transactions worksheet, balance sheet, and activity statement from Second Chance Bakery, Part 1 (please see below), prepare a cash flow statement for

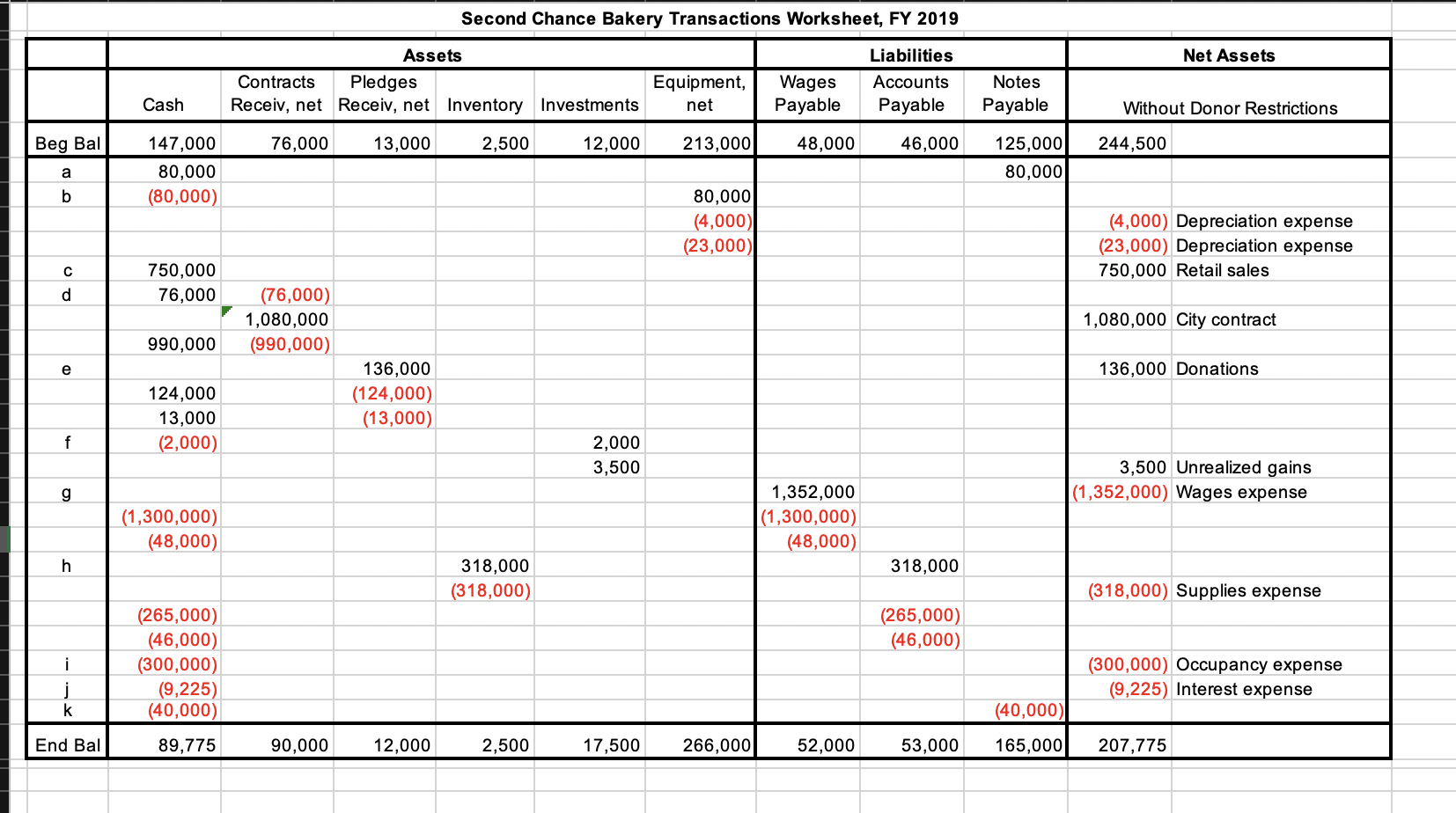

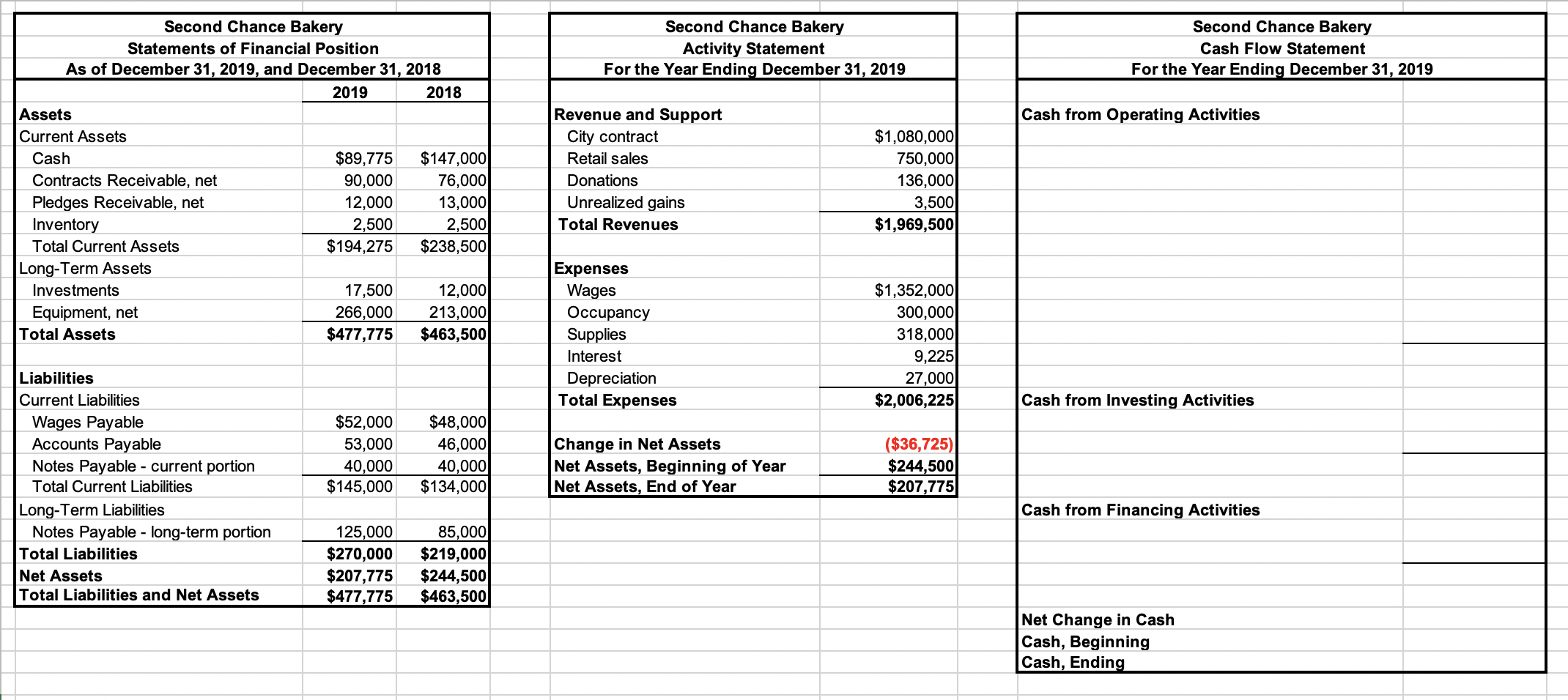

2. Using the transactions worksheet, balance sheet, and activity statement from Second Chance Bakery, Part 1 (please see below), prepare a cash flow statement for Second Chance Bakery for FY 2019.

Second Chance Bakery Activity Statement For the Year Ending December 31, 2019 Second Chance Bakery Cash Flow Statement For the Year Ending December 31, 2019 Cash from Operating Activities Second Chance Bakery Statements of Financial Position As of December 31, 2019, and December 31, 2018 2019 2018 Assets Current Assets Cash $89,775 $147,000 Contracts Receivable, net 90,000 76,000 Pledges Receivable, net 12,000 13,000 Inventory 2,500 2,500 Total Current Assets $194,275 $238,500 Long-Term Assets Investments 17,500 12,000 Equipment, net 266,000 213,000 Total Assets $477,775 $463,500 Revenue and Support City contract Retail sales Donations Unrealized gains Total Revenues $1,080,000 750,000 136,000 3,500 $1,969,500 Expenses Wages Occupancy Supplies Interest Depreciation Total Expenses $1,352,000 300,000 318,000 9,225 27,000 $2,006,225 Cash from Investing Activities Liabilities Current Liabilities Wages Payable Accounts Payable Notes Payable - current portion Total Current Liabilities Long-Term Liabilities Notes Payable - long-term portion Total Liabilities Net Assets Total Liabilities and Net Assets $52,000 53,000 40,000 $145,000 $48,000 46,000 40,000 $134,000 Change in Net Assets Net Assets, Beginning of Year Net Assets, End of Year ($36,725) $244,500 $207,775 Cash from Financing Activities 125,000 $270,000 $207,775 $477,775 85,000 $219,000 $244,500 $463,500 Net Change in Cash Cash, Beginning Cash, Ending

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts