Question: 2) Valuation and returns. The most common way to value projects or assets is to discount the expected cash flows at the risk adjusted discount

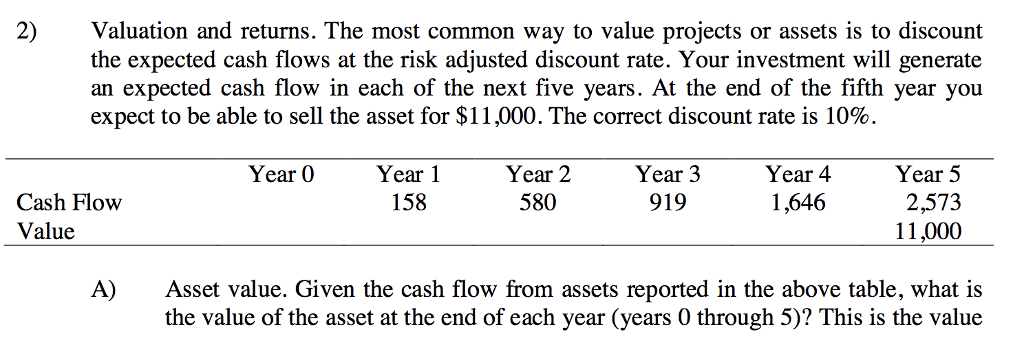

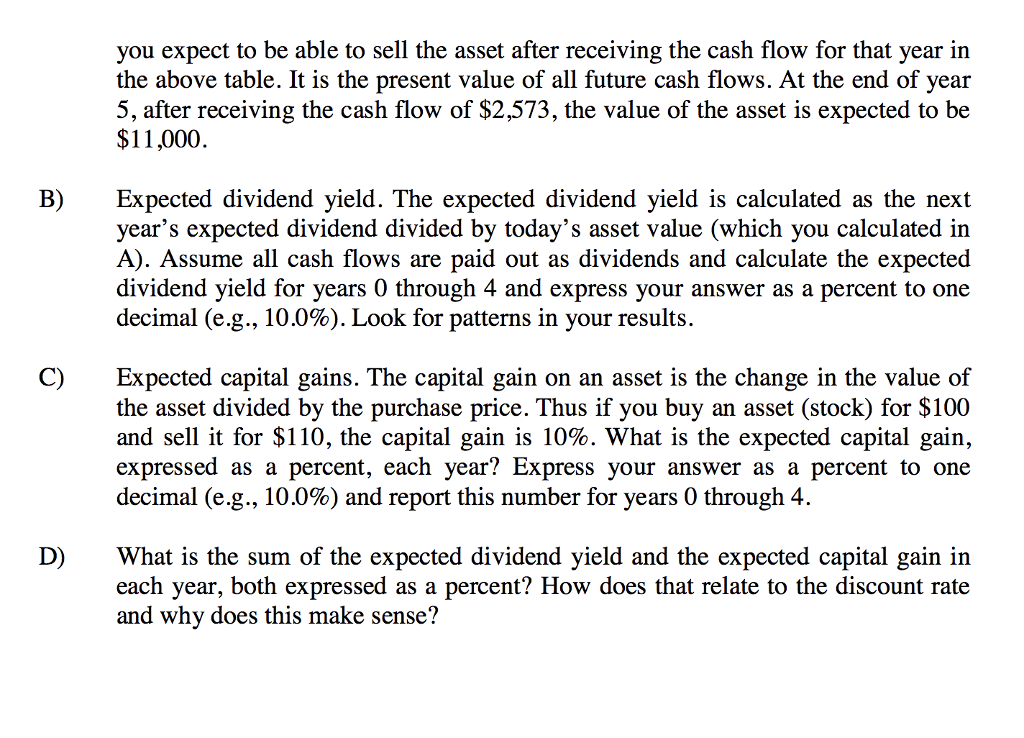

2) Valuation and returns. The most common way to value projects or assets is to discount the expected cash flows at the risk adjusted discount rate. Your investment will generate an expected cash flow in each of the next five years. At the end of the fifth year you expect to be able to sell the asset for $11 ,000. The correct discount rate is 10%. Cash Flow Value YearYear1 Year 580 Year 3 919 Year 4 1 646 Year 5 2,573 1,000 158 A) Asset value. Given the cash flow from assets reported in the above table, what is the value of the asset at the end of each year (years 0 through 5)? This is the value 2) Valuation and returns. The most common way to value projects or assets is to discount the expected cash flows at the risk adjusted discount rate. Your investment will generate an expected cash flow in each of the next five years. At the end of the fifth year you expect to be able to sell the asset for $11 ,000. The correct discount rate is 10%. Cash Flow Value YearYear1 Year 580 Year 3 919 Year 4 1 646 Year 5 2,573 1,000 158 A) Asset value. Given the cash flow from assets reported in the above table, what is the value of the asset at the end of each year (years 0 through 5)? This is the value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts