Question: 2. value: 3.00 points On June 30, 2016, Rosetta Granite purchased a machine for $148,000. The estimated useful life of the machine is eight

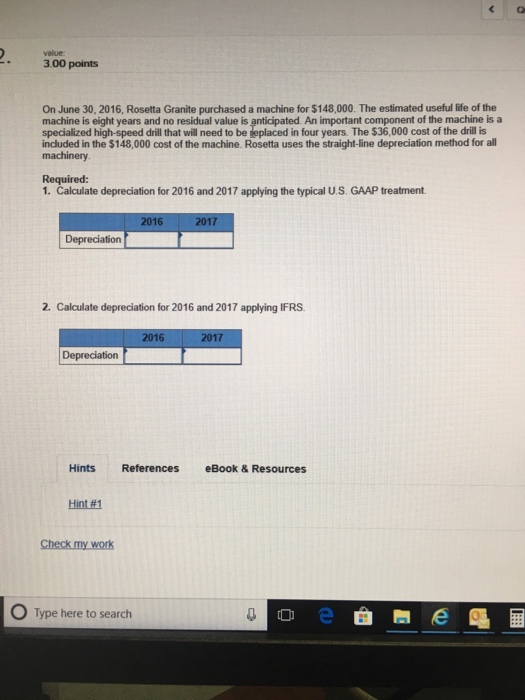

2. value: 3.00 points On June 30, 2016, Rosetta Granite purchased a machine for $148,000. The estimated useful life of the machine is eight years and no residual value is anticipated. An important component of the machine is a specialized high-speed drill that will need to be replaced in four years. The $36,000 cost of the drill is included in the $148,000 cost of the machine. Rosetta uses the straight-line depreciation method for all machinery. Required: 1. Calculate depreciation for 2016 and 2017 applying the typical U.S. GAAP treatment. Depreciation 2016 2017 2. Calculate depreciation for 2016 and 2017 applying IFRS. Depreciation 2016 2017 Hints References eBook & Resources Hint #1 Check my work Type here to search e

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts