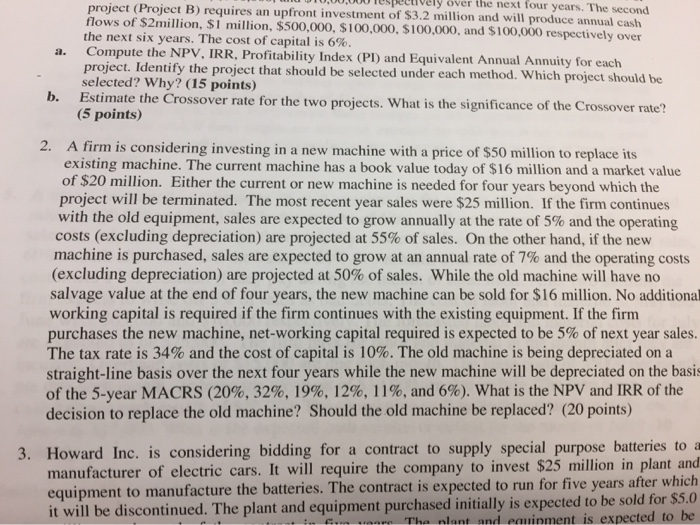

Question: #2 ver the next four years. The second project (Project B) requires an upfront investment of $3.2 million and will produce annual cash flows of

ver the next four years. The second project (Project B) requires an upfront investment of $3.2 million and will produce annual cash flows of $2million, $1 million, $500,000, $100,000, $100,000, and $100,000 respectively over the next six years. The cost of capital is 6%. Compute the NPV, IRR, Profitability Index (PI) and Equivalent Annual Annuity for each project. Identify the project that should be selected under each method. Which project should be selected? Why? (15 points) b. a. Estimate the Crossover rate for the two projects. What is the significance of the Crossover rate? (5 points) 2. A firm is considering investing in a new machine with a price of $50 million to replace its existing machine. The current machine has a book value today of $16 million and a market value of $20 million. Either the current or new machine is needed for four years beyond which the project will be terminated. The most recent year sales were $25 million. If the firm continues with the old equipment, sales are expected to grow annually at the rate of 5% and the operating costs (excluding depreciation) are projected at 55% of sales. On the other hand, if the new machine is purchased, sales are expected to grow at an annual rate of 7% and the operating costs (excluding depreciation) are projected at 50% of sales. While the old machine will have no salvage value at the end of four years, the new machine can be sold for $16 million. No additional working capital is required if the firm continues with the existing equipment. If the firm purchases the new machine, net-working capital required is expected to be 5% of next year sales. The tax rate is 34% and the cost of capital is 10%. The old machine is being depreciated on a straight-line basis over the next four years while the new machine will be depreciated on the basis of the 5-year MACRS (20%, 32%, 19%, 12%, 11%, and 6%). What is the NPV and IRR of the decision to replace the old machine? Should the old machine be replaced? (20 points) 3. Howard Inc. is considering bidding for a contract to supply special purpose batteries to a manufacturer of electric cars. It will require the company to invest $25 million in plant and equipment to manufacture the batteries. The contract is expected to run for five years after which it will be discontinued. The plant and equipment purchased initially is expected to be sold for $5.0 The nlant and eauinment is expected to be firm tanre

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts