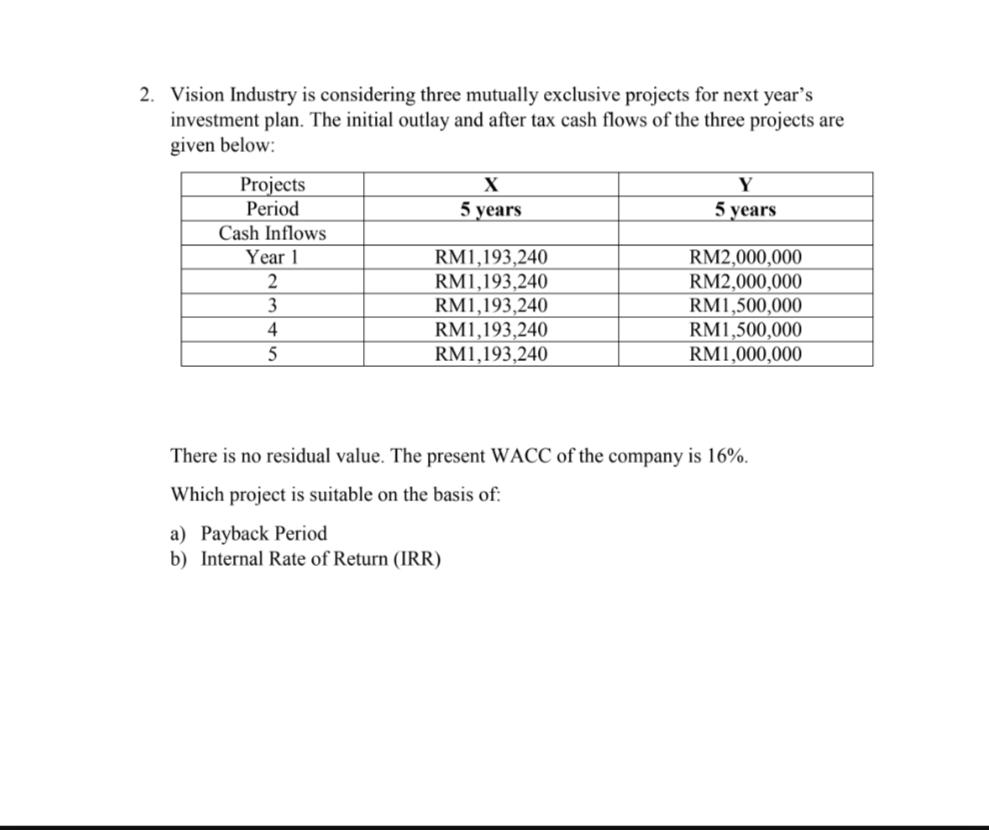

Question: 2. Vision Industry is considering three mutually exclusive projects for next year's investment plan. The initial outlay and after tax cash flows of the three

2. Vision Industry is considering three mutually exclusive projects for next year's investment plan. The initial outlay and after tax cash flows of the three projects are given below: X Y 5 years 5 years Projects Period Cash Inflows Year 1 2 3 4 5 RM1,193,240 RM1,193,240 RM1,193,240 RM1,193,240 RM1,193,240 RM2,000,000 RM2,000,000 RM1,500,000 RM1,500,000 RM1,000,000 There is no residual value. The present WACC of the company is 16%. Which project is suitable on the basis of: a) Payback Period b) Internal Rate of Return (IRR) 2. Vision Industry is considering three mutually exclusive projects for next year's investment plan. The initial outlay and after tax cash flows of the three projects are given below: X Y 5 years 5 years Projects Period Cash Inflows Year 1 2 3 4 5 RM1,193,240 RM1,193,240 RM1,193,240 RM1,193,240 RM1,193,240 RM2,000,000 RM2,000,000 RM1,500,000 RM1,500,000 RM1,000,000 There is no residual value. The present WACC of the company is 16%. Which project is suitable on the basis of: a) Payback Period b) Internal Rate of Return (IRR)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts