Question: 2. We have discussed in our class mostly about fixed-rate coupon bonds that pay coupon payments based on fixed coupon rates. There are also certain

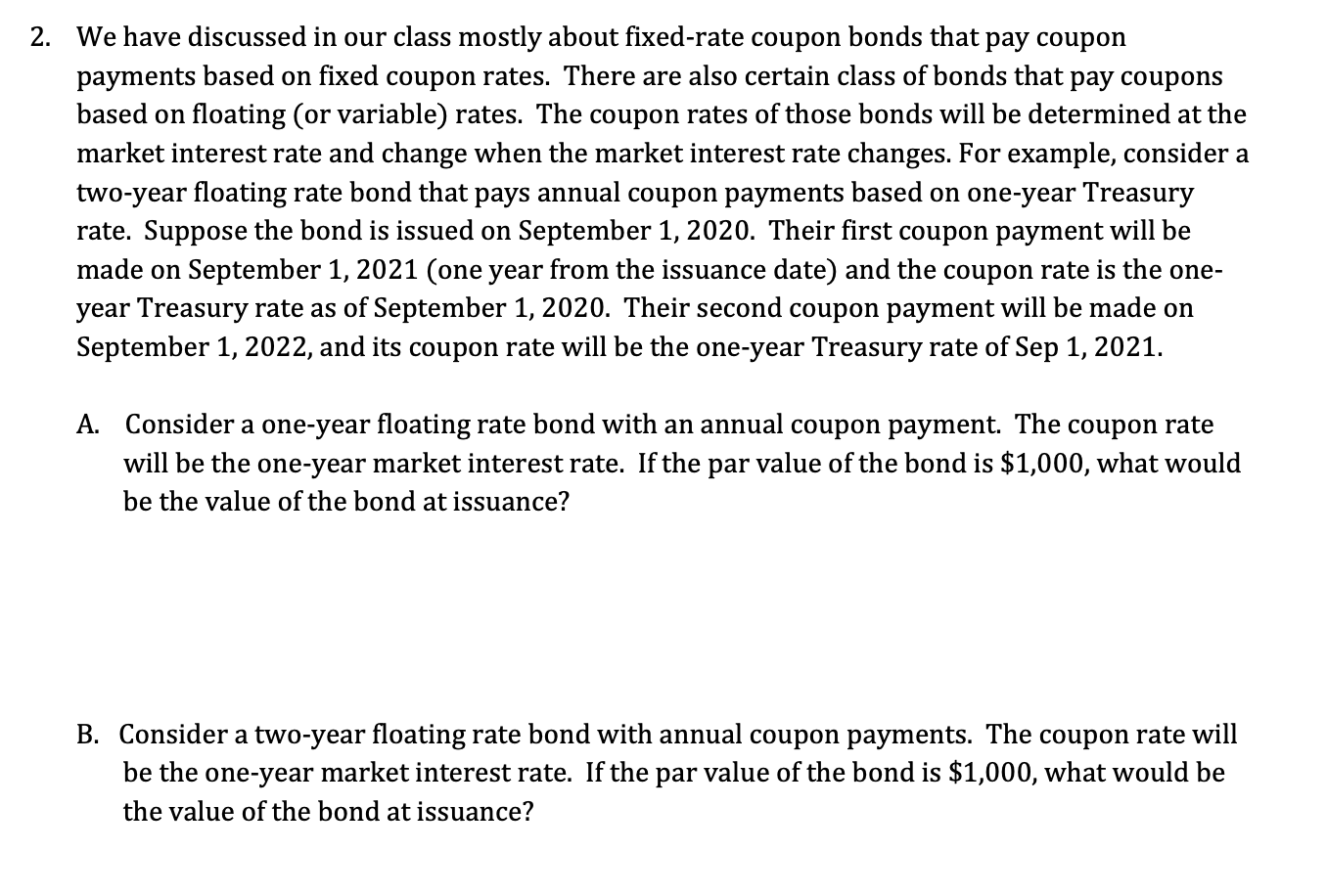

2. We have discussed in our class mostly about fixed-rate coupon bonds that pay coupon payments based on fixed coupon rates. There are also certain class of bonds that pay coupons based on floating (or variable) rates. The coupon rates of those bonds will be determined at the market interest rate and change when the market interest rate changes. For example, consider a two-year floating rate bond that pays annual coupon payments based on one-year Treasury rate. Suppose the bond is issued on September 1, 2020. Their first coupon payment will be made on September 1, 2021 (one year from the issuance date) and the coupon rate is the one- year Treasury rate as of September 1, 2020. Their second coupon payment will be made on September 1, 2022, and its coupon rate will be the one-year Treasury rate of Sep 1, 2021. A. Consider a one-year floating rate bond with an annual coupon payment. The coupon rate will be the one-year market interest rate. If the par value of the bond is $1,000, what would be the value of the bond at issuance? B. Consider a two-year floating rate bond with annual coupon payments. The coupon rate will be the one-year market interest rate. If the par value of the bond is $1,000, what would be the value of the bond at issuance

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts