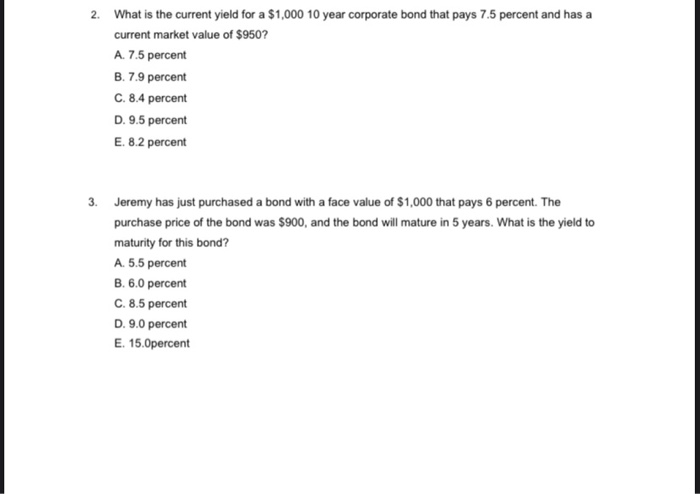

Question: 2. What is the current yield for a $1,000 10 year corporate bond that pays 7.5 percent and has a current market value of $950?

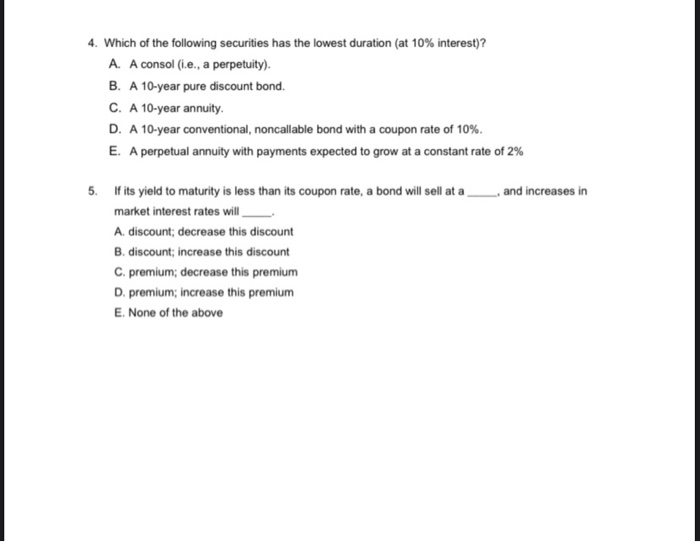

2. What is the current yield for a $1,000 10 year corporate bond that pays 7.5 percent and has a current market value of $950? A. 7.5 percent B. 7.9 percent C. 8.4 percent D. 9.5 percent E. 8.2 percent Jeremy has just purchased a bond with a face value of $1,000 that pays 6 percent. The purchase price of the bond was $900, and the bond will mature in 5 years. What is the yield to maturity for this bond? A. 5.5 percent B. 6.0 percent C. 8.5 percent D. 9.0 percent E. 15.Opercent 4. Which of the following securities has the lowest duration (at 10% interest)? A. A consol (i.e., a perpetuity). B. A 10-year pure discount bond. C. A 10-year annuity. D. A 10-year conventional, noncallable bond with a coupon rate of 10%. E. A perpetual annuity with payments expected to grow at a constant rate of 2% , and increases in If its yield to maturity is less than its coupon rate, a bond will sell at a market interest rates will A. discount; decrease this discount B. discount, increase this discount C. premium, decrease this premium D. premium; increase this premium E. None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts