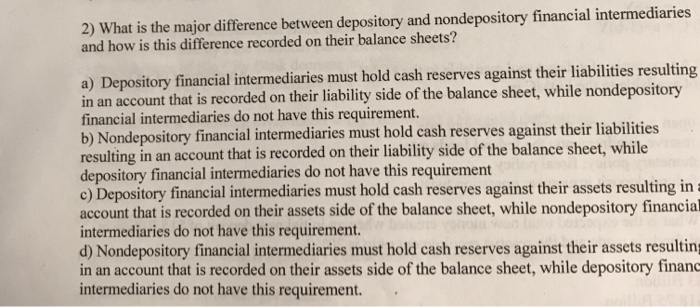

Question: 2) What is the major difference between depository and nondepository financial in and how is this difference recorded on their balance sheets? ial intermediaries must

2) What is the major difference between depository and nondepository financial in and how is this difference recorded on their balance sheets? ial intermediaries must hold cash reserves against their liabilities resulting in an account that is recorded on their liability side of the balance sheet, while nondepository financial intermediaries do not have this requirement. b) Nondepository financial intermediaries must hold cash reserves against their liabilities resulting in an account that is recorded on their liability side of the balance sheet, while depository financial intermediaries do not have this requirement c) Depository financial intermediaries must hold cash reserves against their assets resulting in account that is recorded on their assets side of the balance sheet, while nondepository financial intermediaries do not have this requirement. d) Nondepository financial intermediaries must hold cash reserves against their assets resulting in an account that is recorded on their assets side of the balance sheet, while depository financ intermediaries do not have this requirement

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts