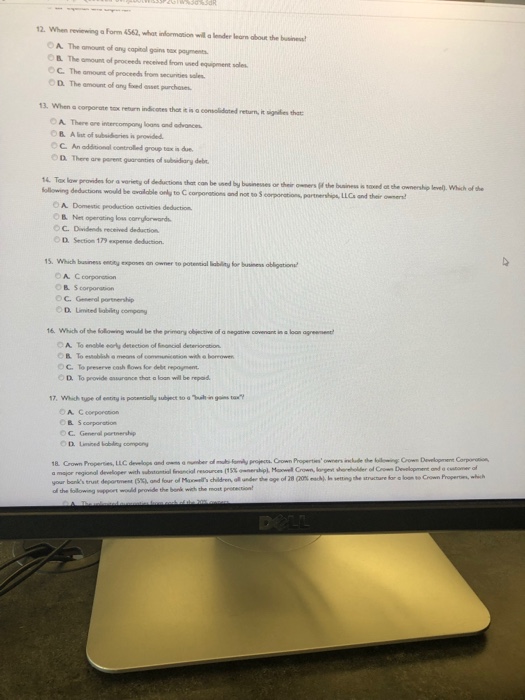

Question: 2 When reviewing a Form 4562, what information will a lender learn about the business A The amount of ang capital goins nex poyments OB

2 When reviewing a Form 4562, what information will a lender learn about the business A The amount of ang capital goins nex poyments OB The amount of proceeds received from uned equipment soles C. The amount of proceed from secunities sole D. The amount of any foxed anset purchoes 13. When a corporate sox rern indicones thot it is a consolidoted return, it signities that OA There are incercompony loans and advances C An additional controlled group tax in due. D There are parent guaranties of sbiday deb or their onners lf he business is toued ot che ownership level). Whih of h corporations partnerships LLCs and their wen ollowing deductions would be available orny to C corporations and not no S OA Domestic production activities deduction B Net operating lous carryforwards C.Dvidends received deduction D. Section 179 expense deduction. 15. Which business enty exposes an owner to potential lisbliny for buniness abligation OA Ccorpontion OC. General portnership D. Limited lability compony A To enoble ed detection o.?ood detenoreten. OC To preserve cosh ows for debrepoment D. To provide assurance shat a loan will be repad 17. Which tupe of entity is pocentialily sject to Teah in gins C. General portnership of the following potwuld provide the bonk wih the most pronetion! 2 When reviewing a Form 4562, what information will a lender learn about the business A The amount of ang capital goins nex poyments OB The amount of proceeds received from uned equipment soles C. The amount of proceed from secunities sole D. The amount of any foxed anset purchoes 13. When a corporate sox rern indicones thot it is a consolidoted return, it signities that OA There are incercompony loans and advances C An additional controlled group tax in due. D There are parent guaranties of sbiday deb or their onners lf he business is toued ot che ownership level). Whih of h corporations partnerships LLCs and their wen ollowing deductions would be available orny to C corporations and not no S OA Domestic production activities deduction B Net operating lous carryforwards C.Dvidends received deduction D. Section 179 expense deduction. 15. Which business enty exposes an owner to potential lisbliny for buniness abligation OA Ccorpontion OC. General portnership D. Limited lability compony A To enoble ed detection o.?ood detenoreten. OC To preserve cosh ows for debrepoment D. To provide assurance shat a loan will be repad 17. Which tupe of entity is pocentialily sject to Teah in gins C. General portnership of the following potwuld provide the bonk wih the most pronetion

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts