Question: 2. Which type of portfolio has shown the highest average annual returns over the period 1925-20137 a. Long term government bonds b. Small company stocks

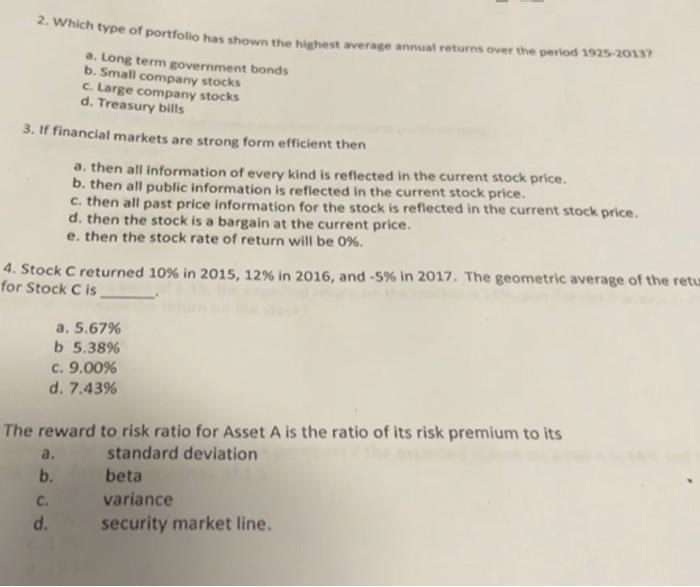

2. Which type of portfolio has shown the highest average annual returns over the period 1925-20137 a. Long term government bonds b. Small company stocks c. Large company stocks d. Treasury bills 3. If financial markets are strong form efficient then a. then all information of every kind is reflected in the current stock price. b. then all public information is reflected in the current stock price. c. then all past price information for the stock is reflected in the current stock price. d. then the stock is a bargain at the current price. e. then the stock rate of return will be 0%. 4. Stock C returned 10% in 2015, 12% in 2016, and -5% in 2017. The geometric average of the retur for Stock C is a. 5.67% b 5.38% c. 9.00% d. 7.43% The reward to risk ratio for Asset A is the ratio of its risk premium to its a. standard deviation b. beta variance security market line. C. d

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts