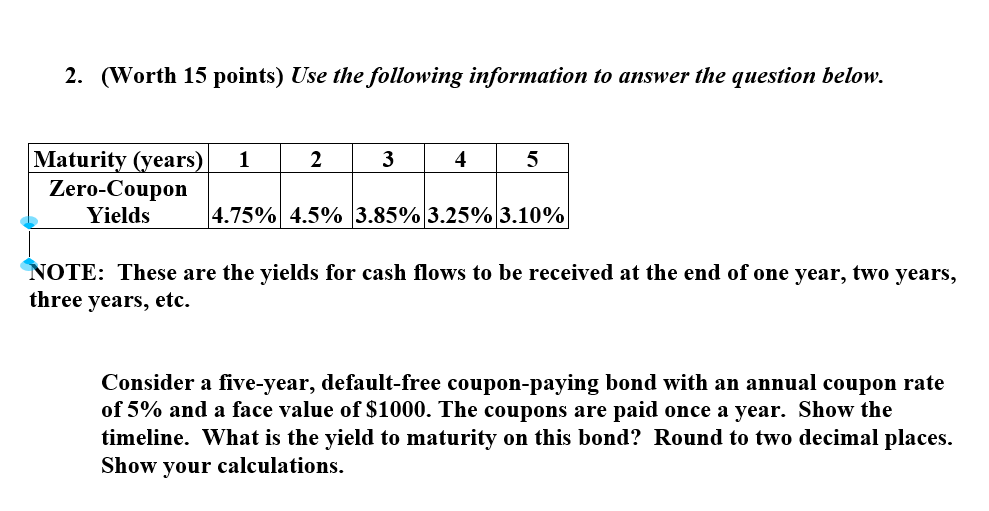

Question: 2 . ( Worth 1 5 points ) Use the following information to answer the question below. Maturity ( years ) 1 2 3 4

Worth points Use the following information to answer the question below.

Maturity years

ZeroCoupon Yields

NOTE: These are the yields for cash flows to be received at the end of one year, two years, three years, etc.

Consider a fiveyear, defaultfree couponpaying bond with an annual coupon rate of and a face value of $ The coupons are paid once a year. Show the timeline. What is the yield to maturity on this bond? Round to two decimal places. Show your calculations.Worth points Use the following information to answer the question below.

NOTE: These are the yields for cash flows to be received at the end of one year, two years,

three years, etc.

Consider a fiveyear, defaultfree couponpaying bond with an annual coupon rate

of and a face value of $ The coupons are paid once a year. Show the

timeline. What is the yield to maturity on this bond? Round to two decimal places.

Show your calculations.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock