Question: 2. Yield to maturity is defined as A) The annualized return from buying a bond at market price and holding it until maturity. B) Semi-annual

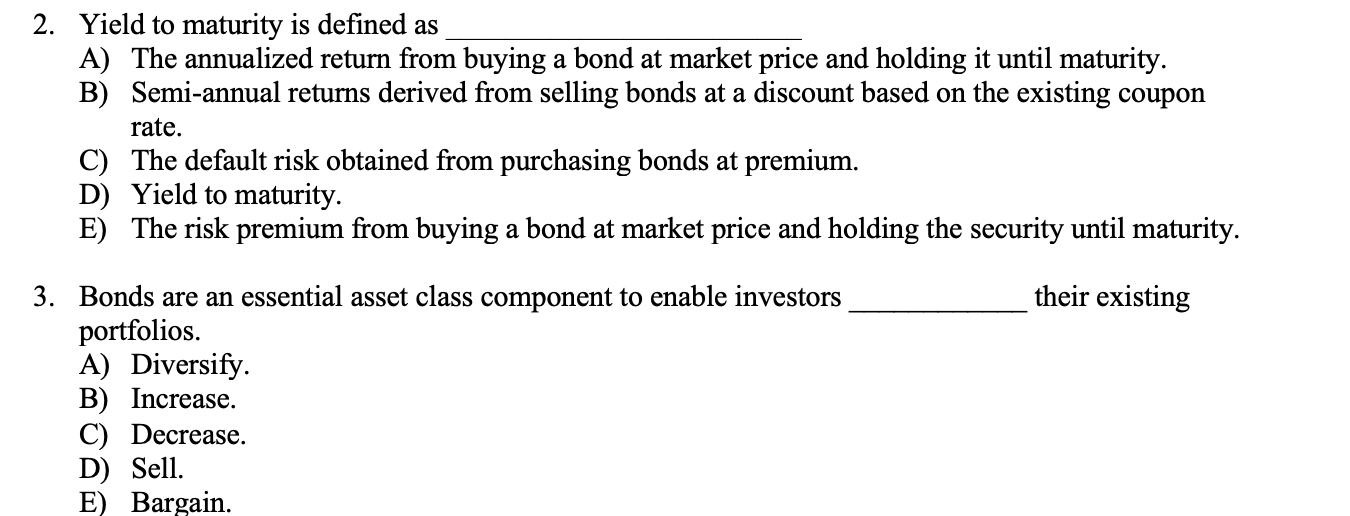

2. Yield to maturity is defined as A) The annualized return from buying a bond at market price and holding it until maturity. B) Semi-annual returns derived from selling bonds at a discount based on the existing coupon rate. C) The default risk obtained from purchasing bonds at premium. D) Yield to maturity. E) The risk premium from buying a bond at market price and holding the security until maturity. their existing 3. Bonds are an essential asset class component to enable investors portfolios. A) Diversify. B) Increase. C) Decrease. D) Sell. E) Bargain

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock