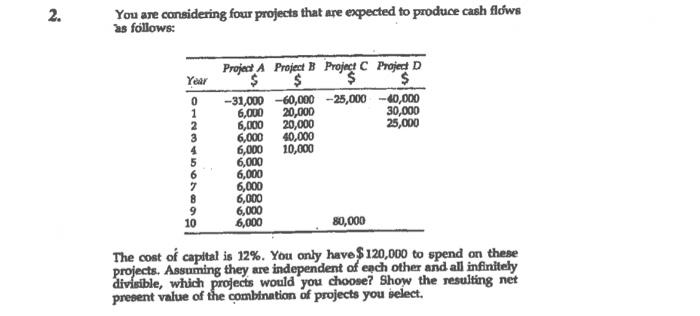

Question: 2. You are considering four projects that are expected to produce cash flows as follows: Year 0 1 2 3 4 5 6 Project A

2. You are considering four projects that are expected to produce cash flows as follows: Year 0 1 2 3 4 5 6 Project A Project B Project C Project D $ $ $ -31,000 -60,000 -25,000 -40,000 6,000 20,000 30,000 6,000 20,000 25,000 6,000 40,000 6,000 10,000 6,000 6,000 6,000 6,000 6,000 6,000 80,000 8 9 10 The cost of capital is 12%. You only have $ 120,000 to spend on these projects. Assuming they are independent of each other and all infinitely divisible, which projects would you choose? Show the resulting net present value of the combination of projects you select

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts