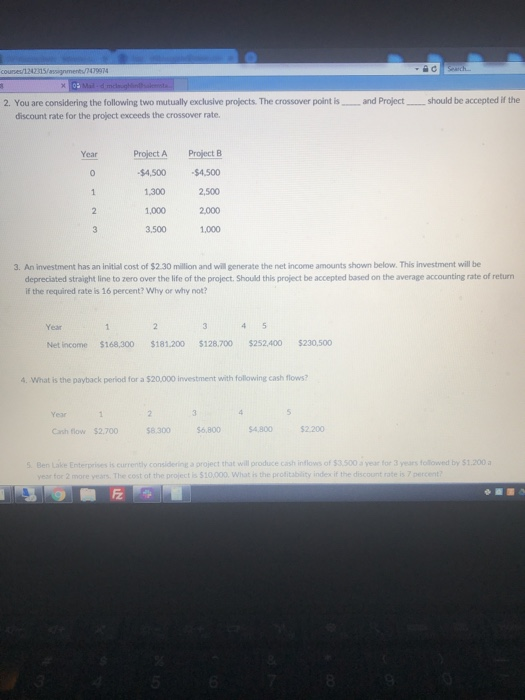

Question: 2. You are considering the following two mutually exclusive projects.The crossover point isand Project should be accepted if the discount rate for the project exceeds

2. You are considering the following two mutually exclusive projects.The crossover point isand Project should be accepted if the discount rate for the project exceeds the crossover rate Project A Project B $4,500 $4,500 2,500 2,000 1,000 1.300 1,000 3,500 3. An investment has an initial cost of $2.30 million and will generate the net income amounts shown below. This investment will be depreciated straight line to zero over the life of the project, Should this project be accepted based on the average accounting rate of return if the required rate is 16 percent? Why or why not? Year Net income $168.300 $181.200 $128.700 $252.400 $230,500 4. What is the payback period for a $20,000 investment with following cash flows? Year Cash flow $2.700 $8.300 $6,800 $4,800 $2.200 S Ben Lake Enterprises is currently considering a oroject that will produce cash inflows of $3.500 a year for 3 years followed by $1.200a year for 2 more years. The cost ot the project is $10,000. What is the protitability index if the discount rate is 7 percent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts