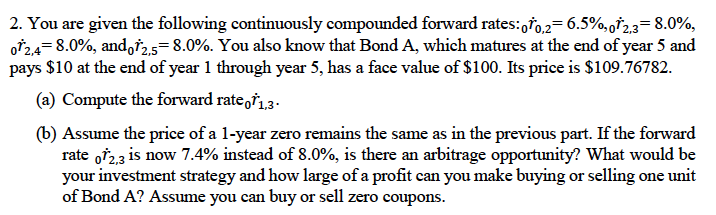

Question: 2. You are given the following continuously compounded forward rates: 070,2= 6.5%,082,3= 8.0%, 072,4= 8.0%, and, 12,5=8.0%. You also know that Bond A, which matures

2. You are given the following continuously compounded forward rates: 070,2= 6.5%,082,3= 8.0%, 072,4= 8.0%, and, 12,5=8.0%. You also know that Bond A, which matures at the end of year 5 and pays $10 at the end of year 1 through year 5, has a face value of $100. Its price is $109.76782. (a) Compute the forward rate 11,3- (6) Assume the price of a 1-year zero remains the same as in the previous part. If the forward rate 12,3 is now 7.4% instead of 8.0%, is there an arbitrage opportunity? What would be your investment strategy and how large of a profit can you make buying or selling one unit of Bond A? Assume you can buy or sell zero coupons. 2. You are given the following continuously compounded forward rates: 070,2= 6.5%,082,3= 8.0%, 072,4= 8.0%, and, 12,5=8.0%. You also know that Bond A, which matures at the end of year 5 and pays $10 at the end of year 1 through year 5, has a face value of $100. Its price is $109.76782. (a) Compute the forward rate 11,3- (6) Assume the price of a 1-year zero remains the same as in the previous part. If the forward rate 12,3 is now 7.4% instead of 8.0%, is there an arbitrage opportunity? What would be your investment strategy and how large of a profit can you make buying or selling one unit of Bond A? Assume you can buy or sell zero coupons

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts