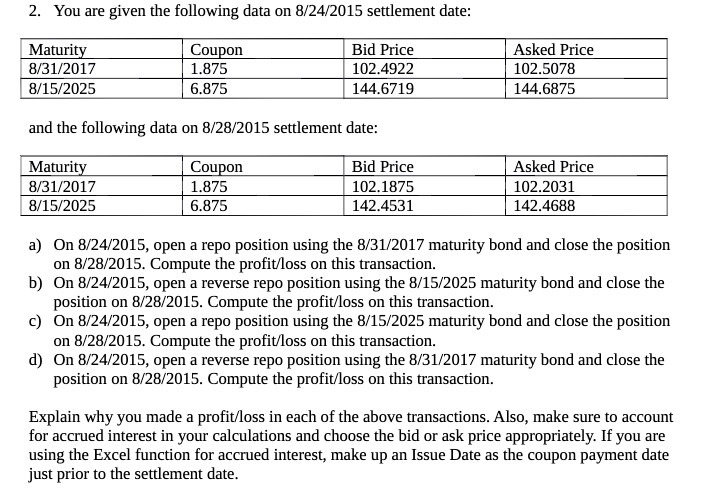

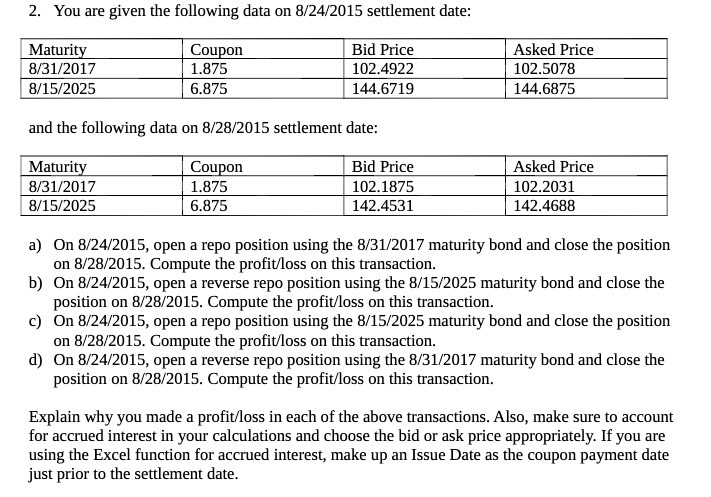

Question: 2. You are given the following data on 8/24/2015 settlement date: Maturity Coupon Bid Price Asked Price 8/31/2017 1.875 102.4922 102.5078 8/15/2025 6.875 144.6719 144.6875

2. You are given the following data on 8/24/2015 settlement date: Maturity Coupon Bid Price Asked Price 8/31/2017 1.875 102.4922 102.5078 8/15/2025 6.875 144.6719 144.6875 and the following data on 8/28/2015 settlement date: Maturity Coupon Bid Price Asked Price 8/31/2017 1.875 102.1875 102.2031 8/15/2025 6.875 142.4531 142.4688 a) On 8/24/2015, open a repo position using the 8/31/2017 maturity bond and close the position on 8/28/2015. Compute the profit/loss on this transaction. b) On 8/24/2015, open a reverse repo position using the 8/15/2025 maturity bond and close the position on 8/28/2015. Compute the profit/loss on this transaction. c) On 8/24/2015, open a repo position using the 8/15/2025 maturity bond and close the position on 8/28/2015. Compute the profit/loss on this transaction. d) On 8/24/2015, open a reverse repo position using the 8/31/2017 maturity bond and close the position on 8/28/2015. Compute the profit/loss on this transaction. Explain why you made a profit/loss in each of the above transactions. Also, make sure to account for accrued interest in your calculations and choose the bid or ask price appropriately. If you are using the Excel function for accrued interest, make up an Issue Date as the coupon payment date just prior to the settlement date

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts