Question: 2. You have been asked to evaluate these three mutually exclusive alternatives each with a different useful life. Your company's MARR is 20%. Project A

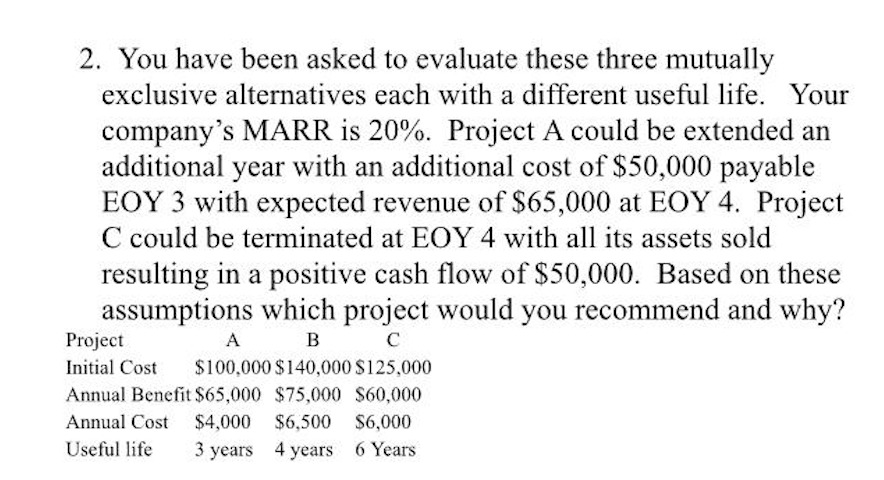

2. You have been asked to evaluate these three mutually exclusive alternatives each with a different useful life. Your company's MARR is 20%. Project A could be extended an additional year with an additional cost of $50,000 payable EOY 3 with expected revenue of $65,000 at EOY 4, Project C could be terminated at EOY 4 with all its assets sold resulting in a positive cash flow of $50,000. Based on these assumptions which project would you recommend and wh? Project Initial Cost $100,000 $140,000 S125,000 Annual Benefit $65,000 $75,000 S60,000 Annual Cost $4,000 $6,500 S6,000 Useful life 3 years 4 years 6 Years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts