Question: 2. You have been assigned as an analyst for comparing the performances of Blackburn Banking Corporation with Delta Banking Corporation during the year 2019, both

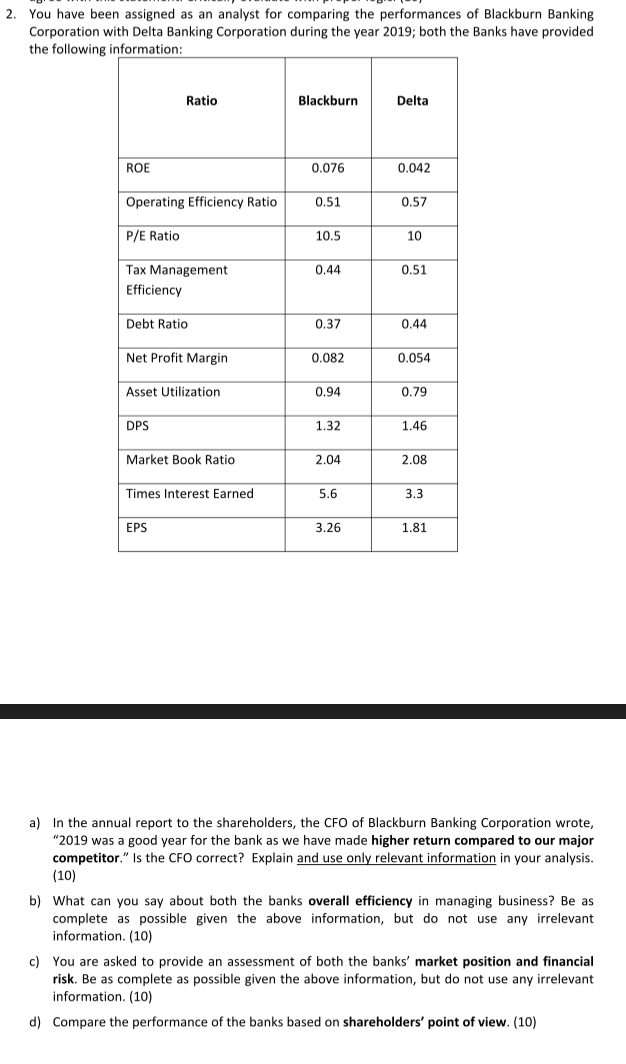

2. You have been assigned as an analyst for comparing the performances of Blackburn Banking Corporation with Delta Banking Corporation during the year 2019, both the Banks have provided the following information: Ratio Blackburn Delta ROE 0.076 0.042 Operating Efficiency Ratio 0.51 0.57 P/E Ratio 10.5 10 0.44 0.51 Tax Management Efficiency Debt Ratio 0.37 0.44 Net Profit Margin 0.082 0.054 Asset Utilization 0.94 0.79 DPS 1.32 1.46 Market Book Ratio 2.04 2.08 Times Interest Earned 5.6 3.3 EPS 3.26 1.81 a) In the annual report to the shareholders, the CFO of Blackburn Banking Corporation wrote, "2019 was a good year for the bank as we have made higher return compared to our major competitor." Is the CFO correct? Explain and use only relevant information in your analysis. (10) b) What can you say about both the banks overall efficiency in managing business? Be as complete as possible given the above information, but do not use any irrelevant information. (10) c) You are asked to provide an assessment of both the banks' market position and financial risk. Be as complete as possible given the above information, but do not use any irrelevant information. (10) d) Compare the performance of the banks based on shareholders' point of view

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts