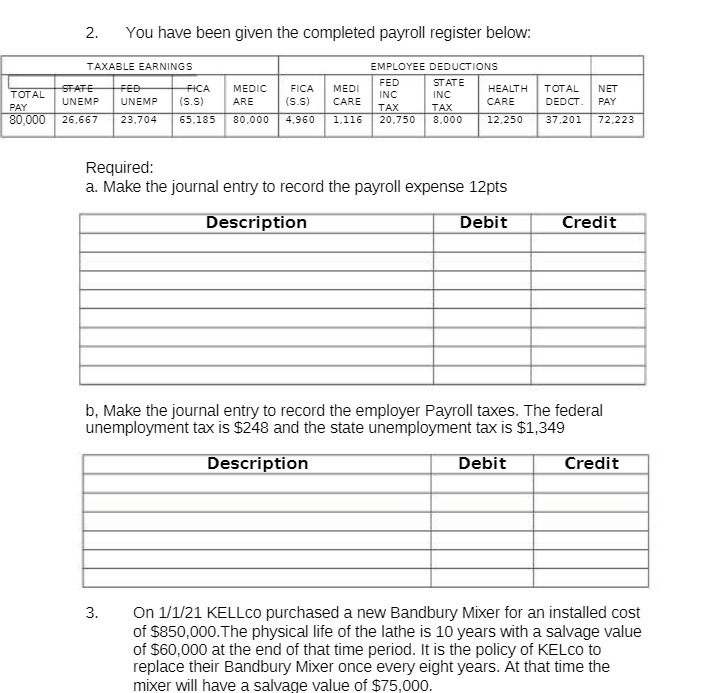

Question: 2. You have been given the completed payroll register below: TAXABLE EARNINGS EMPLOYEE DEDUCTIONS STATE FEB -FICA MEDIC FICA MEDI FED STATE NET TOTAL INC

2. You have been given the completed payroll register below: TAXABLE EARNINGS EMPLOYEE DEDUCTIONS STATE FEB -FICA MEDIC FICA MEDI FED STATE NET TOTAL INC INC HEALTH TOTAL PAY UNEMP UNEMP (S.S) ARE (S.S) CARE TAX TAX CARE DEDCT. PAY 80,000 26,667 23.704 65,185 80,000 4.960 1,116 20.750 8,000 12,250 37.201 72.223 Required: a. Make the journal entry to record the payroll expense 12pts Description Debit Credit b, Make the journal entry to record the employer Payroll taxes. The federal unemployment tax is $248 and the state unemployment tax is $1,349 Description Debit Credit 3. On 1/1/21 KELLco purchased a new Bandbury Mixer for an installed cost of $850,000. The physical life of the lathe is 10 years with a salvage value of $60,000 at the end of that time period. It is the policy of KELco to replace their Bandbury Mixer once every eight years. At that time the mixer will have a salvage value of $75,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts