Question: 2. You would like to estimate how much a single taxpayer that itemizes on their individual tax return Schedule A. You randomly select 65 single

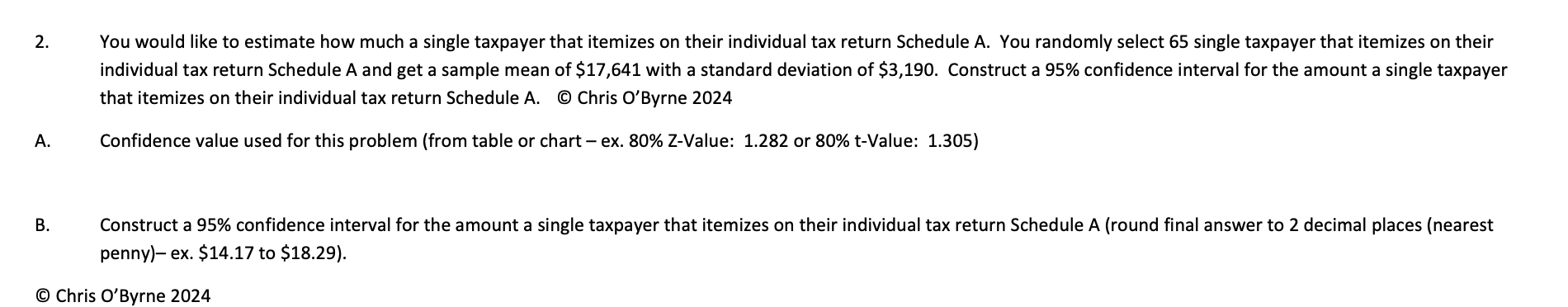

2. You would like to estimate how much a single taxpayer that itemizes on their individual tax return Schedule A. You randomly select 65 single taxpayer that itemizes on their individual tax return Schedule A and get a sample mean of $17,641 with a standard deviation of $3,190. Construct a 95% confidence interval for the amount a single taxpayer that itemizes on their individual tax return Schedule A. Chris O'Byrne 2024 A Confidence value used for this problem (from table or chart ex. 80% Z-Value: 1.282 or 80% t-Value: 1.305) B. Construct a 95% confidence interval for the amount a single taxpayer that itemizes on their individual tax return Schedule A (round final answer to 2 decimal places (nearest penny)ex. $14.17 to $18.29). Chris O'Byrne 2024

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts