Question: 2. Your boss is piling on the work and has asked you to value three more potential acquisitions. They are of Northern, Eastern and Central,

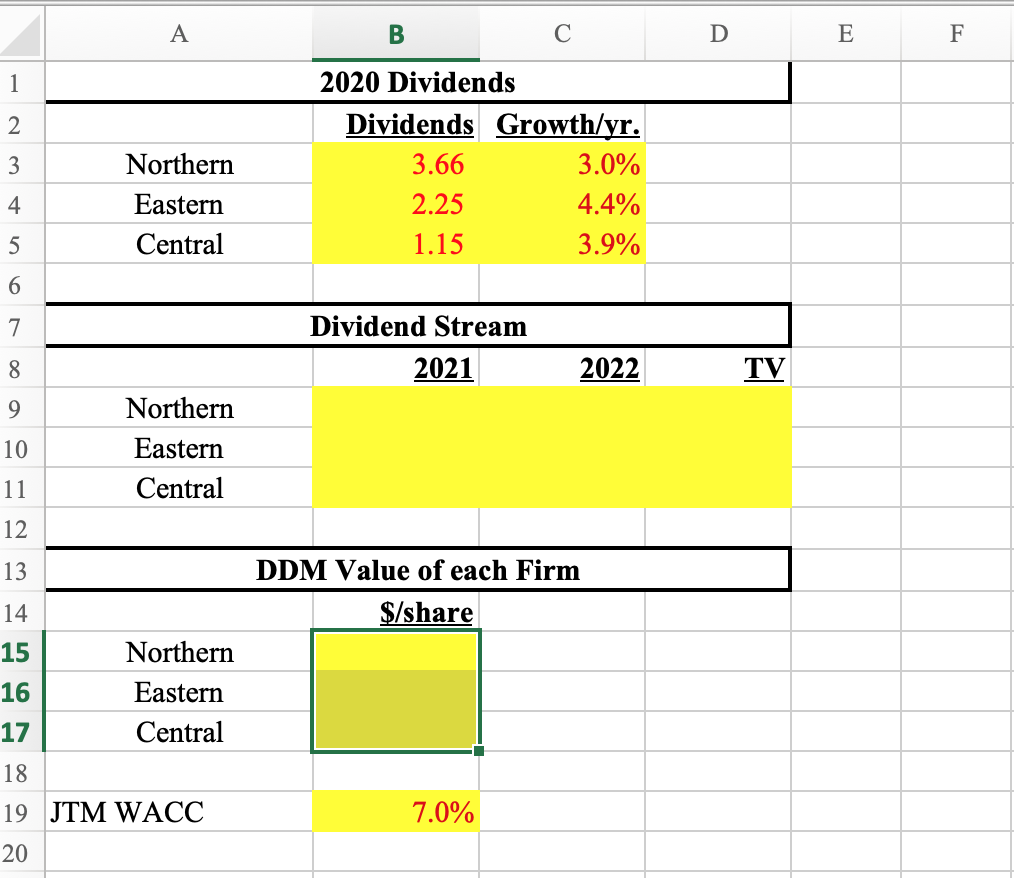

2. Your boss is piling on the work and has asked you to value three more potential acquisitions. They are of Northern, Eastern and Central, fixed base operators serving areas where JTM is looking to expand (the names give away the regions of the country). You don't have cash flow data for these firms as they are privately held, but you talked to the owners and they gave you dividend information for the firms, which you entered into your spreadsheet. You remember back to your corporate finance class that you can use the Dividend Discount Model (DDM) to come up with a quick and dirty valuation. You know JTM'S WACC and will use this as the applicable discount rate. Using the DDM Model, what are the values per share of each of these three firms? A B D E F 1 2 3 2020 Dividends Dividends Growth/yr. 3.66 3.0% 2.25 4.4% 1.15 3.9% Northern Eastern Central 4 5 6 7 Dividend Stream 8 2021 2022 TV 9 10 Northern Eastern Central 11 12 13 DDM Value of each Firm 14 $/share 15 16 17 Northern Eastern Central 18 19 JTM WACC 7.0% 20

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts