Question: 2. Your company is considering a project which requires a $30,000 initial investment with a pre- dicted salvage value at the end of its six

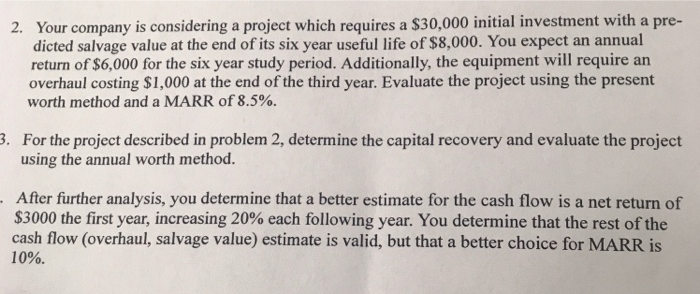

2. Your company is considering a project which requires a $30,000 initial investment with a pre- dicted salvage value at the end of its six year useful life of $8,000. You expect an annual return of $6,000 for the six year study period. Additionally, the equipment will require an overhaul costing $1,000 at the end of the third year. Evaluate the project using the present worth method and a MARR of 8.5%. . For the project described in problem 2, determine the capital recovery and evaluate the project using the annual worth method. After further analysis, you determine that a better estimate for the cash flow is a net return of $3000 the first year, increasing 20% each following year. You determine that the rest of the cash flow (overhaul, salvage value) estimate is valid, but that a better choice for MARR is 10%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts