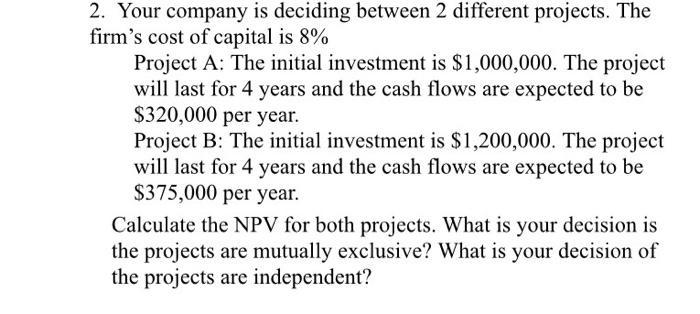

Question: 2. Your company is deciding between 2 different projects. The firm's cost of capital is 8% Project A: The initial investment is $1,000,000. The

2. Your company is deciding between 2 different projects. The firm's cost of capital is 8% Project A: The initial investment is $1,000,000. The project will last for 4 years and the cash flows are expected to be $320,000 per year. Project B: The initial investment is $1,200,000. The project will last for 4 years and the cash flows are expected to be $375,000 per year. Calculate the NPV for both projects. What is your decision is the projects are mutually exclusive? What is your decision of the projects are independent?

Step by Step Solution

There are 3 Steps involved in it

Project A Initial investment 1000000 Expected annual cash flow 320000 Project duration ... View full answer

Get step-by-step solutions from verified subject matter experts