Question: 2. Your firm processes 50,000 checks each year with an average face.value of $50 per check. Collecting on these checks requires two days of mail

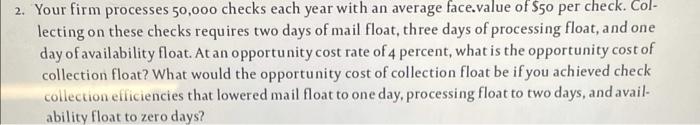

2. Your firm processes 50,000 checks each year with an average face.value of $50 per check. Collecting on these checks requires two days of mail float, three days of processing float, and one day of availability float. At an opportunity cost rate of 4 percent, what is the opportunity cost of collection float? What would the opportunity cost of collection float be if you achieved check collection efficiencies that lowered mail float to one day, processing float to two days, and availability float to zero days

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock